Investment update - April 2024

Market update

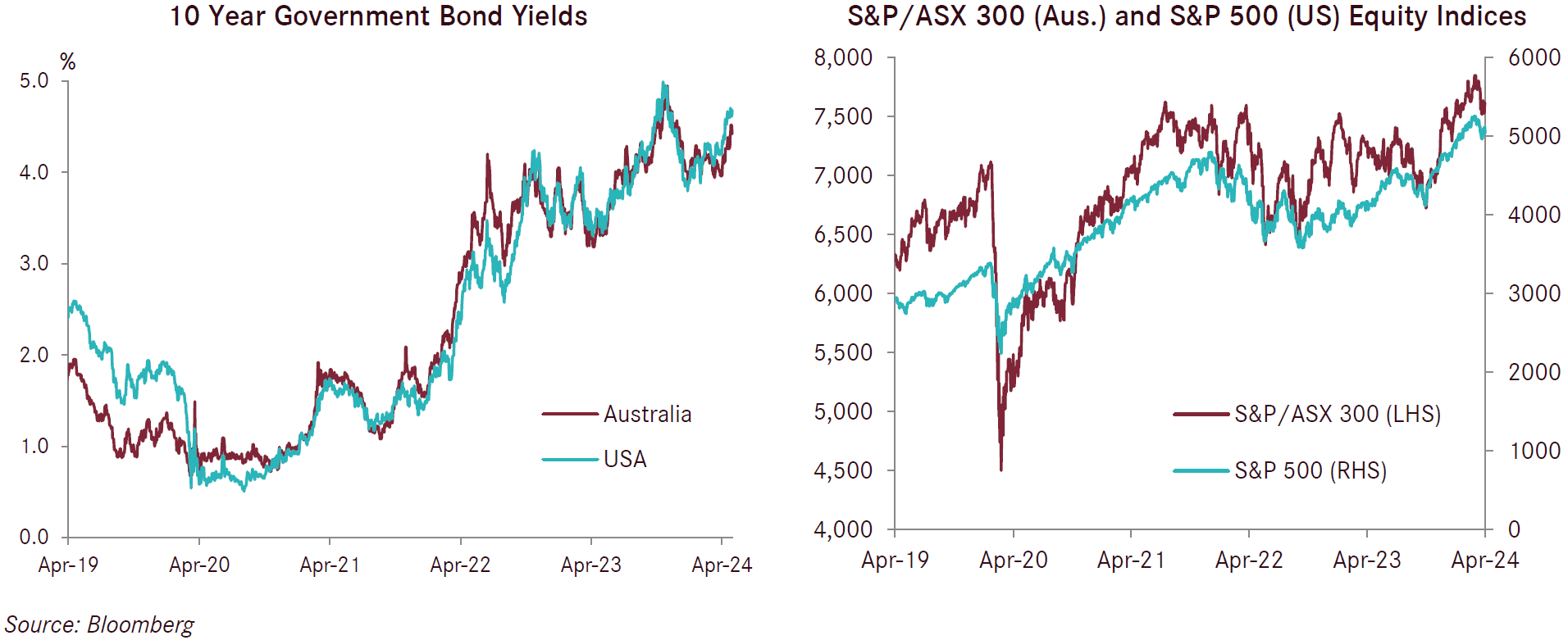

Share markets took a breather in March after having a very strong run over the prior six months. Australian shares and developed international shares (hedged) fell 2.9% and 3.3% respectively for the month. While it was a particularly weak month, over 12 months Australian shares are up 9% and developed international shares (hedged) are up 19%. The US and Japan led the selloff in April with international shares recording falls of 4.2% and 4.9% respectively. In Europe, the German DAX was 3% lower while the UK FTSE was the standout positive performer, up 2.4% for the month. Fixed income returns were poor as yields rose driven by concerns around stronger than expected inflation readings. This resulted in returns of -2% for Australian fixed income and -1.7% for international fixed income for the month of April.

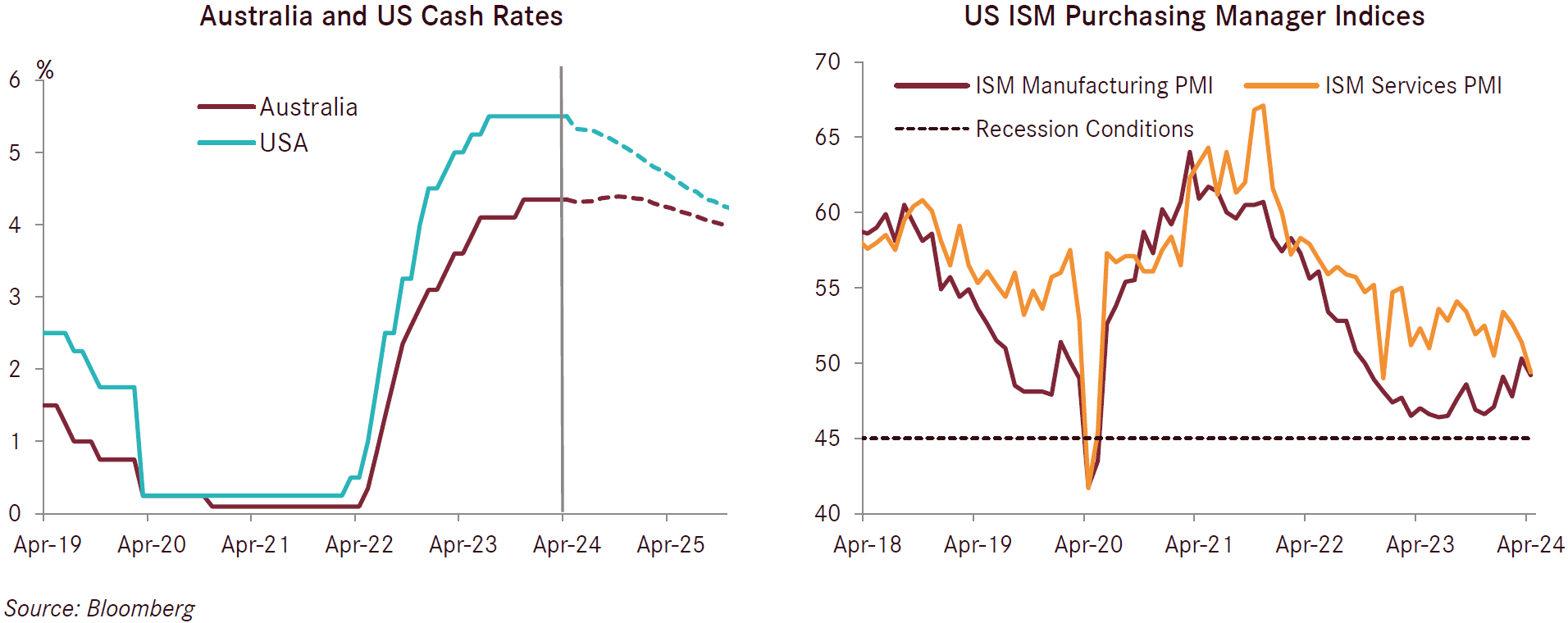

The market selloff in April was driven by higher-than-expected inflation readings in the US along with signs that the very important US consumer is starting to become more cautious. While Powell has continued his dovish guidance for markets and stuck with his guidance for three interest rate cuts this year, bond markets have largely priced these out. This is a significant change compared to just a few months ago where markets were pricing in five interest rate cuts in 2024.

There is divergence of growth and inflation between the US and the rest of the developed world, though this appears to be inverting. US economic data is moderating and inflation surprising to the high side, whereas improving economic conditions and disinflation is becoming more evident in most other developed economies. In Australia, consumer inflation expectations have materially increased, similarly to that seen in the US. With a large proportion of home loans attached to the variable interest rate, the impact of higher interest rates is being clearly felt, however, the RBA is now not expected to change interest rates for some time and even now markets are pricing a small possibility that there could be an increase in interest rates. The key risk in the near term is inflation not moderating as quickly as expected, leading to more hawkish central banks and higher interest rates.

The Reserve Bank of Australia kept the official interest rate at the current level of 4.35% at its April meeting. The minutes from the RBA meeting took a more hawkish tone, essentially saying it will not rule anything in or out but acknowledging that inflation is stickier than it would like. Along with the stronger inflation and response from the RBA, markets have priced out any rate cuts for this year. The Australian consumer remains very subdued as measured by the Westpac Melbourne Institute Consumer Sentiment Index which fell by 2.4% to a level of 82.4 points and remains at levels considered very weak, consistent with widespread concern and pessimism. Australian retail sales took a dive in March, recording a fall of 0.4% versus consensus expectations of a 0.2% gain. Australian business confidence eased in April with the NAB Business Conditions Index decreasing 2 points to a level of +14 points though it remains above long-term average levels.

The US economy had been the tower of global economic strength for much of 2023 and into the start of the 2024, however, there are growing signs that this growth is moderating. Q1 2024 GDP surprised considerably to the downside coming in at 1.1% and well below expectations of 2% and down from Q4 2023 growth of 2.6%. Much of the surprise was due to a large drawdown in inventories however there was also a large downwards revision in retail sales reinforcing concern about the strength of the US consumer. This softer economic data was also seen with a few other key leading and coincident economic indicators. The University of Michigan consumer sentiment index recorded its largest drop in more than three years with a fall of nearly 10 points to a level of 67.4 and was materially weaker than expectations. While this is just a single data point and therefore difficult to draw any conclusions from, other consumer related data over the next month or two will be watched closely for signs of the US consumer’s health. The importance of the US consumer cannot be underestimated given consumer spending accounts for approximately 70% of US GDP. The US Services ISM Index fell in April with a reading of 49.4 and moved the index into contraction territory, ending a period of 15 months of continuous growth. US Manufacturing ISM fell in April with the index down 1.1 points to 49.4 and is back at a level consistent with a contracting manufacturing sector. Payrolls increased by 175,000 in April, which was lower than expected, with much of the growth coming from the health care sector. While overall the US continues to show reasonable growth, there are some signs of a slowing consumer that could pose a risk to the economic outlook.

Bond yields in the US have increased considerably in recent months and again through the course of April. The combination of higher-than-expected inflation and large fiscal deficits leading to elevated debt funding issuance have resulted in markets deferring expected interest rate cuts for 2024 until 2025. The pricing out of interest rate cuts poses headwinds on consumer sentiment and with it increases the risks of economic weakness. While the Fed Reserve is retaining a dovish narrative, markets are not so confident - progress towards lower inflation is required in coming months, or this will present a challenge for equity markets that remain at elevated levels.

Leading economic indicators generally continued to improve over the course of March and April. Euro Area GDP for Q1 2024 came in at 0.3%, well ahead of market expectations of 0.1%. This improvement in growth somewhat took the pressure off the ECB to cut interest rates until it has seen whether the progress on inflation proves more challenging than initially expected, as is being seen in the US. The Conference Board’s leading economic indicator declined by 0.4% in March, to a level of 99.4, while the Conference Board’s coincident indicator of economic activity increased to 108.3, up 0.2 points over March. Soft and deteriorating conditions for the manufacturing sector continued with the HCOB Eurozone Manufacturing PMI coming in at 45.7 in April, down from 46.1 in March. While manufacturing remains subdued, the services sector is showing ongoing signs of strength with the HCOB Eurozone Services PMI increasing to 53.3 in April from 51.5 in March. The services sector, which makes up approximately 75% of GDP and employment across Europe is being driven higher by strong underlying demand.

Inflation continues to moderate in the Eurozone with inflation slowing to 2.4% year on year to end April and inline with expectations. Core CPI slowed to 2.9% over the 12 months to end April which was also inline with expectations. The good progress on inflation will be welcome news for the ECB, however, the recent sticky inflation in other countries and in particular the US has the ECB cautious about cutting interest rates too early.

The S&P Global UK Manufacturing PMI posted soft performance in April with the index falling to 49.1 in April, down from 50.3 in March and driven mainly by soft output and new orders. The services PMI came in at 55.0 in April, up from 53.1 in March, led by a strong increase in new orders. Survey respondents commented on improving business and consumer spending underpinning robust demand and growth in new orders. UK inflation continued to fall in April, dropping to 3.2% and down from 3.4% in March. While this is an ongoing welcome improvement it was a marginally higher than expectations which were at 3.1%. The reduced inflation alongside a more dovish tone from the Bank of England has markets pricing interest rate cuts in the near future.

China’s economic data continued to improve over March and April. Q1 2024 Chinese GDP came in at 5.3%, above consensus of 4.9%. The Caixin China General Manufacturing PMI increasing to 51.4 in April, up from 51.1 in March and slightly better than market expectations of 51.0. On the services side of the economy, the Caixin China General Services PMI decreased slightly to 52.5 in April, down from 52.7 in March and was pleasingly driven by growth in new activity and improving confidence. Chinese retail sales grew less than expected at 3.1% in the year to end March which was well below market forecasts of 4.5%. Inflation continued in April with a result of 0.3% for the month of April and this marks three consecutive months of inflation after experiencing a period of deflation in 2023. Chinese authorities continue to balance the deleveraging of the property market along with a desire from the government to see more of a consumer driven economy against a more moderate economic growth scenario without further fiscal and monetary stimulus.