Investment update - August 2024

Market update

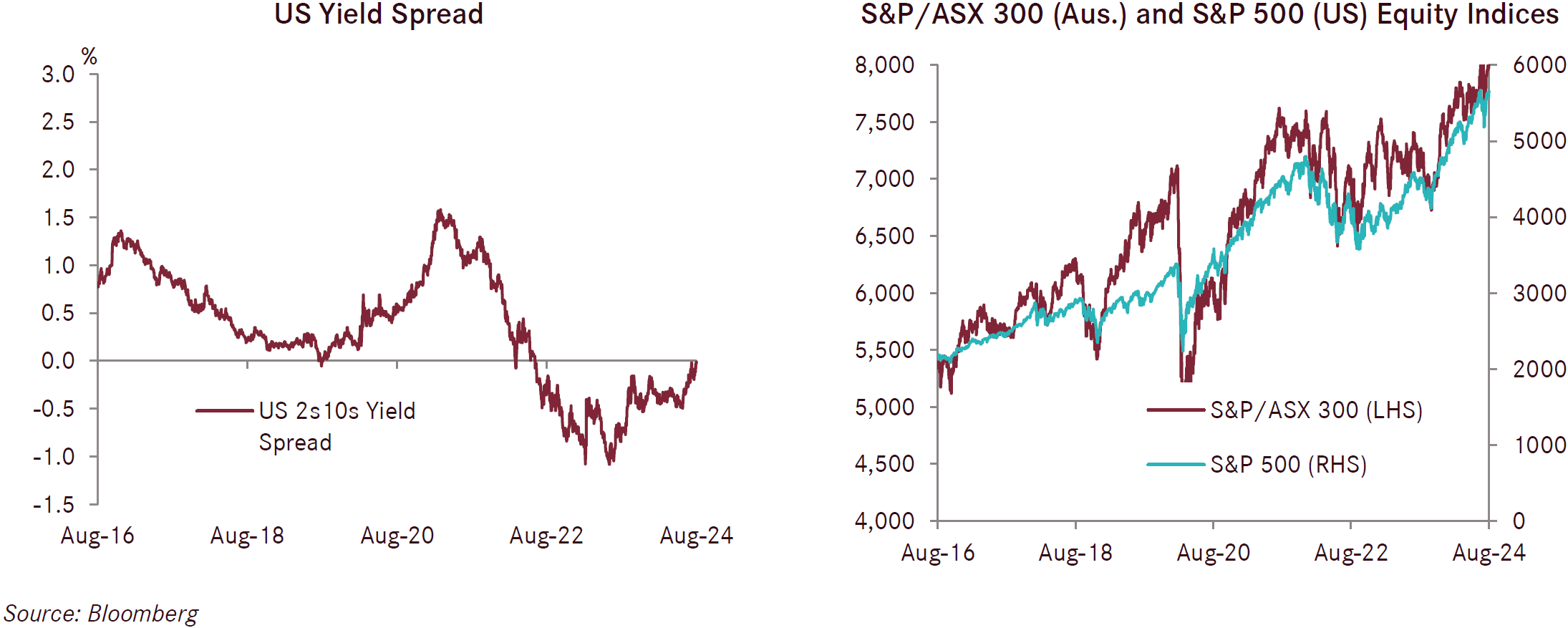

The US S&P 500 increased in August by 2.3%, adding to its very strong performance in recent times. The US market was the strongest performer for the month compared to other major developed share markets and was driven by increasing expectations of aggressive interest rate cuts from the US Federal Reserve. Developed international shares (hedged) were 1.8% higher over the month. Unhedged international shares were weaker, falling by 1.2% in August as the Australian dollar increased in value, decreasing the value of international shares for Australian investors. Australian shares were flat over the month. In Europe, the German market was the standout performer, increasing by 2.2%, while the French index was up 1.3%, and the UK just 0.1% higher.

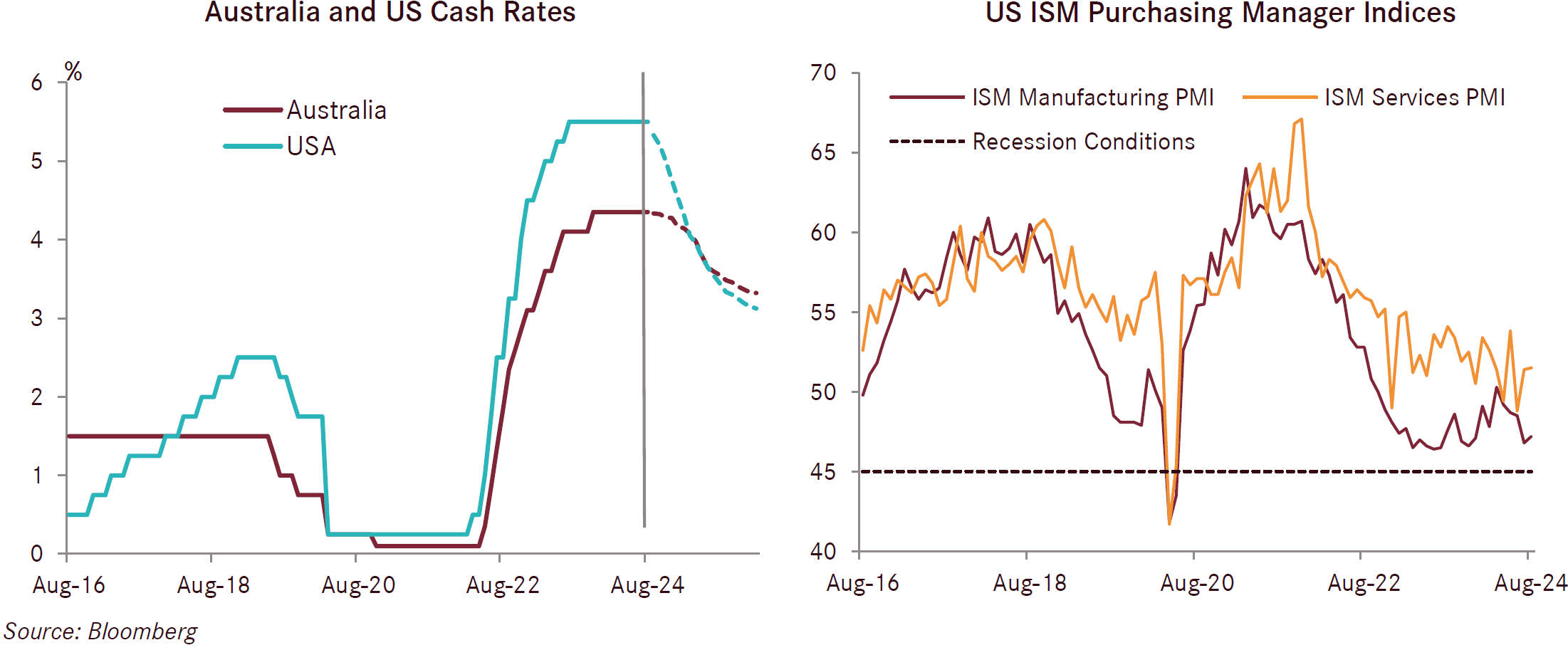

The US economy continued to soften somewhat, with a lot of attention on the labour market data which suggests the US economy is cooling. Inflation also came in softer than expected (2.9% versus 3% expected), further supporting the argument for the Fed to commence its easing cycle. The Chairman of the US Federal Reserve, Jeremy Powell, gave a very dovish speech during the month which further supported the market’s expectations of interest rate cuts. Should the Fed commence cutting rates as expected at its September meeting, it would join many other central banks already underway in cutting interest rates. For these central banks that have started easing, the general trends of moderating inflation and softening economic data are underpinning their decisions. European data was generally inline with expectations, with the broader Euro area delivering modest GDP growth of 0.6% for the second quarter, while core inflation came in at 2.8% for the 12 months to end August.

Fixed income asset classes performed strongly over the course of August with Australian fixed income up 1.2% and international fixed income up 1.0% for the month. Bond markets have continued to increase their expectations of considerably more interest rate cuts than central banks are flagging. For example, the US bond market is now pricing in eight interest rate cuts through to the end of 2025, more than twice that flagged by the US Federal Reserve. Bond markets appear to be foreseeing considerable economic weakness ahead.

Australian GDP came in broadly as expected at 0.2% for the June quarter and 1.0% for the 12 months to end June. The underlying drivers were consistent with that seen in recent times, which is a very weak consumer with high inflation and high interest rates reducing disposable income and therefore consumption. New business investment and housing construction were very soft, with a gain of just 0.1% for the quarter. Consistent with recent surveys, public demand (government) is currently the key driver of growth in the Australian economy. The growth of public spending continues and is now at a record 27.3% share of the economy. In contrast, the outlook for the Australian consumer remains very soft. Westpac Bank modelling suggests that approximately half of the pandemic savings buffer has now been spent and the savings rate was just 0.6% at the end of June. With wage growth data over the June quarter softer than expected at 0.8%, consumers are hoping that the Reserve Bank of Australia (RBA) will provide interest rate cuts to ease the burden. Relief on this front however is expected to be some way off as inflation remains above the RBA’s target - this has Australia out of step with most other developed economies that have either commenced, or are about to commence, cutting interest rates.

The RBA’s governor, Michelle Bullock, has recently pushed back on growing calls to cut interest rates. She points to high and sticky inflation alongside the large fiscal spending from State and Federal Governments which is likely to push inflation up even higher. Federal Government Treasurer, Jim Chalmers, recently expressed his frustrations with the RBA’s hawkish comments given the soft state of the economy and very weak consumer sentiment. This has also resulted in public commentary, both criticism and support of the current Labour Government’s criticism of the RBA from former Federal Treasurers Peter Costello and Wayne Swan. Unless inflation moderates meaningfully and/or the economy softens substantially, it is likely that interest rate relief for the Australian consumer is some way off.

While headline inflation in the US moderated by more than expected in August, Core Personal Consumption Expenditure inflation remained at 2.6% year over year to end August, and was slightly higher than market forecasts of 2.5%. The focus of financial markets has been, and will likely continue to be, the strength of the labour market. In August, the unemployment rate fell slightly from 4.3% to 4.2%, however, nonfarm payrolls (new hires) were weaker than forecast at 142,000 in the month of August. Of even greater focus was the July estimate of 114,000 new jobs being revised down to 89,000. The number of job openings continues to fall and at a faster rate than previously seen.

The US ISM Services PMI improved slightly in August, increasing slightly from 51.4 to 51.5. The backlog of new orders fell considerably while the employment subindex moderated from 51.1 to 50.2, supportive of the softening labour market data seen elsewhere. The manufacturing index edged slightly higher and increased to 47.2 from 46.8 over the course of August. Inventories led the growth, increasing from 44.5 to 50.3 while new orders decreased from 47.4 to 44.6. Overall, the US economy appears to be softening though remains on a solid footing. Markets will watch data releases closely over coming months to see if this softening deteriorates more materially, which in turn would see fears of a recession grow considerably.

Following the European Central Bank’s 25 basis point rate cut in June, the ECB has taken a cautious approach, wanting to see inflation moderate further. Markets are expecting the ECB to cut interest rates by another 25 basis points in September as inflation has continued to fall. Headline inflation fell to 2.2% for the 12 months to end August, inline with expectations and this now sits at the lowest rate seen since July 2021. Core inflation also moderated inline with expectations and came in at 2.8% over the 12 months to end August.

The Conference Board’s Leading Economic Indicator for the Euro Area declined by 0.7% in July, down to 96.7, while the Conference Board’s Coincident Economic Index increased marginally, up 0.1% to 108.7. The HCOB Eurozone Manufacturing Index was unchanged at 45.8 in August from July. Manufacturers continue to face pressure with soft output continuing across most countries, but with Germany and France leading the weakness. New orders also fell rapidly, leading to retrenchment and cost cutting measures increasingly being used to manage through the weak environment. The services sector PMI increased, rising to 52.9 in August, its seventh monthly increase and well ahead of expectations of 51.9. The survey cited strong domestic orders from within the Eurozone while the outstanding work fell for a fourth month in a row. The European Commission Consumer Confidence index decreased slightly in August (-0.1%) and is seen to be consolidating its gains. The European consumer remains key to the Euro Area’s economic growth outlook and increasing optimism and confidence in the short term will likely be driven by interest rate cuts from the ECB.

The flash PMI UK economic survey data from S&P Global continued to increase in August, rising to 53.8 from 52.8. Both services and manufacturing indices increased at faster rates, portraying an improving outlook for the UK economy. The S&P Global UK Manufacturing PMI Survey increased to 52.5 in August from 52.1 in July, its fourth monthly increase in a row, which was driven by a sharp increase in new orders. The S&P Global UK Services PMI increased to 53.7 from 52.5 and was the tenth consecutive month of growth. The Bank of England (BoE) cut its cash rate by 0.25% to 5% at its August meeting and markets are expecting the BoE to hold rates at its September meeting. The BoE is taking a cautious approach and wants to see inflation moderate further before cutting interest rates again.

China’s economic data improved slightly, though is still soft in absolute terms. Headline inflation increased to 0.6% in the 12 months to end August though this was below market expectations. Retail sales rose by 2.7% over the 12 months to end July and were slightly ahead of market expectations of 2.6%. Sales were driven heavily by beverages, sports and recreation, communication equipment and petroleum. In short, consumer confidence remains very depressed overall. The National Bureau of Statistics Consumer Confidence Survey stands at 86 in July and just above an all time low of 85.5 seen in November 2022 during the pandemic. The ongoing transition to a low growth, consumption led economy from a highly indebted starting point is proving challenging. Multiple fiscal and monetary easing announcements have not yet had any meaningful impact. The Caixin China General Services PMI declined slightly to 51.6 from 52.1 in July and was below market expectations, while the Caixin China General Manufacturing PMI rose to 50.4 in August, above market expectations of 50.0.