Investment update - December 2023

Market update

Optimism regarding potential 2024 central bank rate cuts closed out the year on a positive note, as both equities and fixed income markets extended their November rally into December. By complete contrast to the outlook only 12 months prior, the end of 2023 has delivered a degree of hopefulness of looser monetary policy due to softening inflation. Whilst this has been most pronounced in the United States, where a ‘soft landing’ outcome appears plausible, other major economies like the United Kingdom and the eurozone also continue to show signs of easing price pressures. Australia, who appeared an outlier last month, has since exhibited an encouraging slowdown to both price pressures. Conflict in the Middle-East remains a concern as a critical maritime trade route in the Red Sea has come under threat, though financial markets have been left largely unaffected by the events to date.

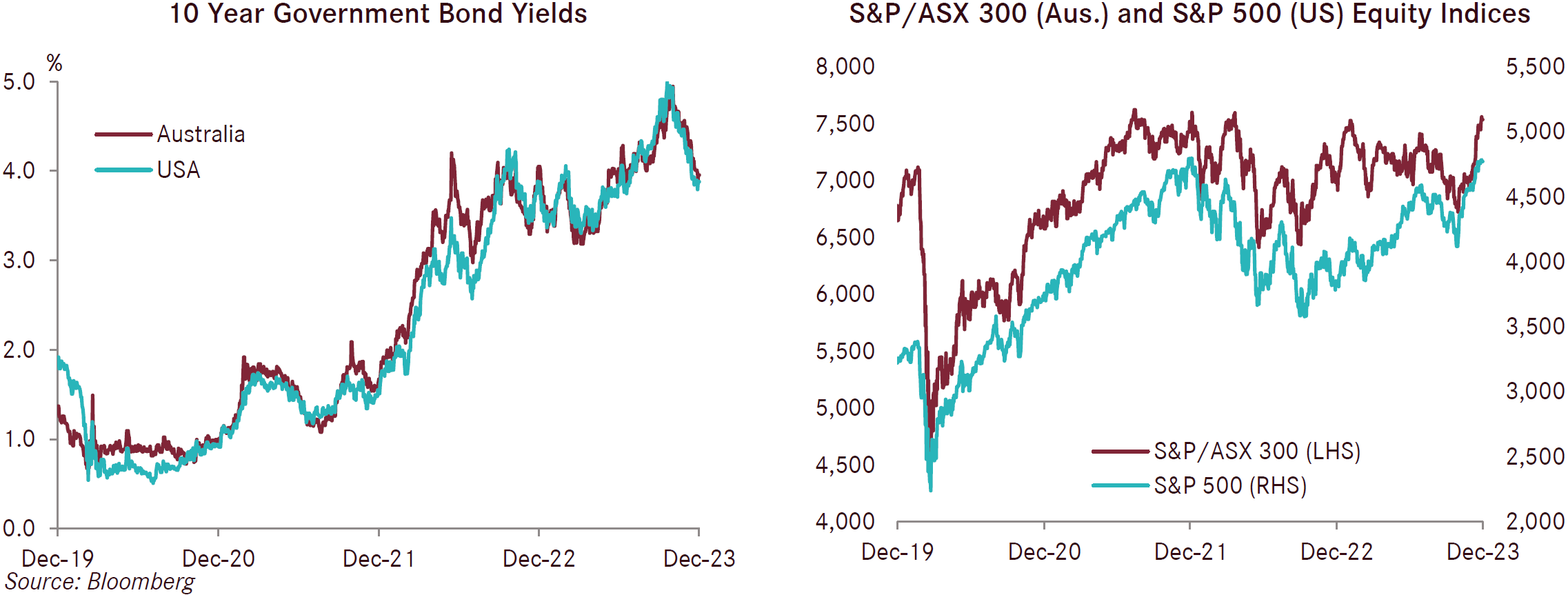

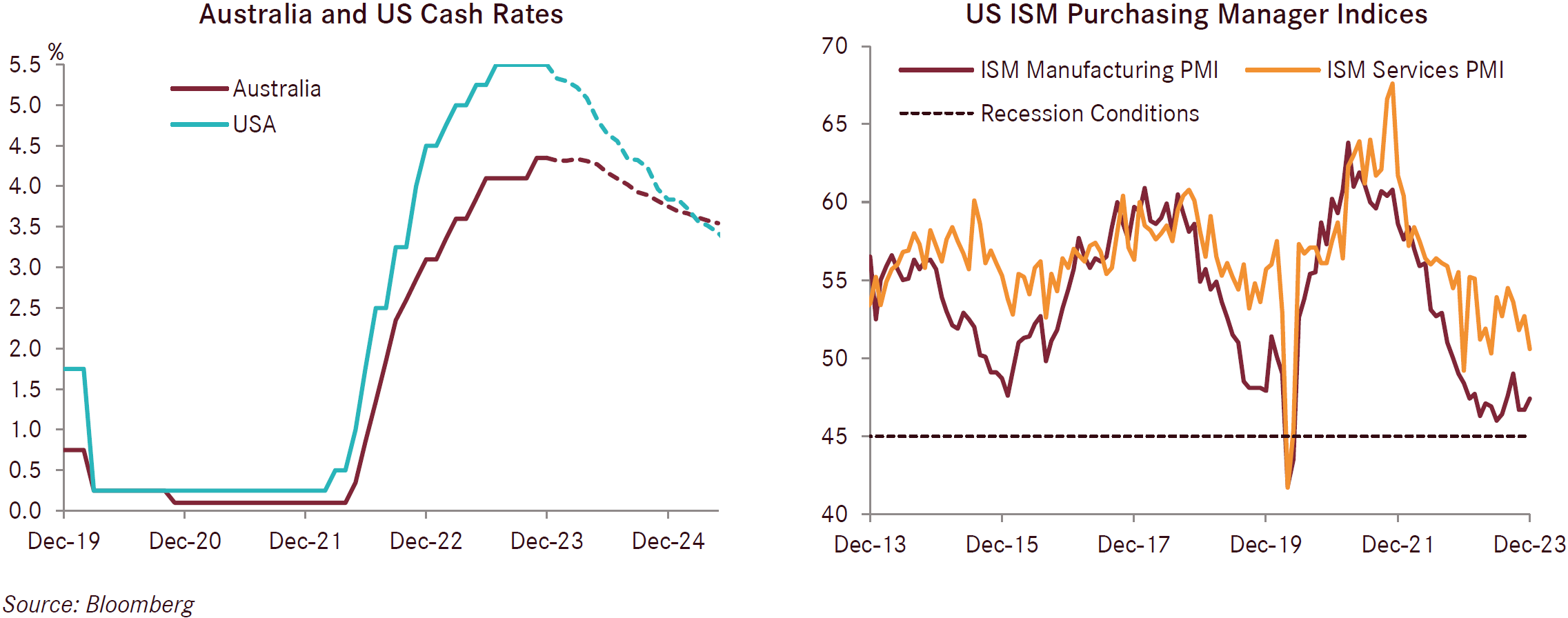

After having raised the rate to 4.35% the month prior, the Reserve Board of Australia (RBA) left the cash rate target unchanged in December, citing that the limited data released since the November meeting had been broadly in line with expectations. The RBA continues to note the potential for further tightening of monetary policy if high inflation becomes entrenched and is paying particular attention to real wage growth and inflation expectations. Whilst these are expected to slow down and become consistent with the inflation target over time, the surprising resilience of household expenditure and tight labour market conditions threaten to extend the duration of elevated domestic interest rates. Despite this possibility, bond markets rallied after the RBA’s decision, and fell nearly 50 basis points in December to just under 4% by the end of the year. Public opinion is split on the rate cycle outlook in Australia, with a survey of 42 economists by the Australian Financial Review forecasting that the RBA will not commence cutting rates by September 2024, whilst the market is more optimistic, pricing in at two rate cuts in 2024 commencing in August.

The RBA’s by-design slowdown of the Australian economy is beginning to be seen in Australia’s labour market, which has slackened somewhat, with the unemployment rate ticking up to 3.9% in November – the highest since May 2022. Whilst actual employment levels rose by 61,500 in November, it is primarily the uplift to the participation rate to a record high 67.2% that has driven up the unemployment rate, with cost-of-living pressures bringing people into the workforce. This should conversely ease pressure on wages noting that the wage price index rose by a record 1.3% during the September quarter.

Both economic outlook and activity softened in the November NAB Business Survey released in December, as business confidence fell -6 points to its lowest level since 2012 (aside from the COVID period), and business conditions eased downwards -4 points, though remained above the long-run average. The results suggest that Q4 growth is unlikely to improve from the weak Q3 results. The Westpac-Melbourne Institute Consumer Sentiment Index lifted modestly by 2.7% for the month due to easing concerns regarding imminent rate hikes. However, it remains at a very weak 82.1, and marks 2023 as the second worst calendar year for Australian consumer sentiment on record (the survey began in 1974).

Meanwhile, the notion of a US ‘soft landing’ following the current hiking cycle gained further traction this month. Inflation fell to 3.1% in the year ending in November, marginally down from 3.2% in October, assisted by the continued decline in gasoline prices, though offset by a rise in the index for shelter. The Fed’s December decision to leave the policy rate at 5.25% - 5.5% for the third consecutive meeting came alongside new central bank forecasts pointing to 75 basis points worth of rate cuts in 2024. The Fed’s decision and relatively dovish forecasts were tailwinds for investor sentiment, as futures markets began pricing as many as six rate cuts next year. As such, the US 10-year government bond yield closed out 2023 just under 3.9% after having reached 5% only two months before. Additionally, the dovish outlook for the federal funds rate helped the S&P 500 finish the year at its third strongest yearly return over the last decade, notching up an impressive 24% return for 2023 despite the high levels of volatility throughout the year, including a regional banking crisis in March.

The US economy continued to be relatively robust, typified by its tight labour market, with the US unemployment rate remaining unchanged at 3.7%. Total nonfarm payroll employment increased by a notable 216,000 in December, though this was dulled by a 71,000 downwards revision to October and November figures. However, leading economic indicators suggest that the economy is beginning to lose some momentum. US manufacturing continued to show signs of weakness, with the US ISM manufacturing PMI remaining in contractionary territory for the 14th straight month in November, whilst the US ISM Services PMI at 50.6 in December was notably down on the previous reading of 52.7 and approaching the sub-50 level that would indicate contraction. In addition, while the unemployment rate has remained low, the number of job openings has fallen 27% from its peak above 12 million in March 2022, to the current reading of 8.8 million.

December data confirmed the UK’s sluggish economic growth in 2023, with Q3 GDP contracting for the quarter, and closing out only marginally above end-2022 levels. Importantly, UK CPI surprised on the low side in November, with the headline and core falling 0.2% and 0.6% to 3.9% and 5.1% respectively (versus expectations of 4.3% and 5.6%). This marked the first period since the hiking cycle began that real wages have been positive in the UK, buoying hope of increased household consumption in the new year. By contrast, in the Eurozone, headline inflation rose to 2.9% in December, a reversal from the six months of consecutive falls. However, this pick-up in inflation is largely reflective of the reduction to heavy energy and food subsidies, particularly in Germany and France, which have been withdrawn over the last 12 months.

After inflation in Japan appeared to be on a sustained rise in the month prior, November saw core inflation slow sharply to 2.5% from 2.9% in October, while headline inflation fell faster than expected to 2.6% from 3.2%, and against market consensus of a rate of 3.0%. Accordingly, the Bank of Japan (BOJ) maintained its loose policy and large stimulus settings at its end-December meeting (cash rate at -0.1% and 10-year bond yield target of 0%), requiring more evidence of high prices inducing a sustained wage-inflation cycle. In response, the Japanese yen tumbled, and its domestic equities had positive gains.

In a bid to stimulate economic growth in China, state-run banks coordinated a reduction in deposit rates for the third time in 2023. This came as China’s recovery from the COVID-19 pandemic continues to disappoint, and mounting concerns over the banking sector’s historically low net interest margins. Additionally, household deposits have jumped 12% in 2023 due to concerns over the economy and reduced appetite to invest. Meanwhile, the Caixin services PMI rose slightly in December to 52.9 from 51.5 in the month prior, and was ahead of consensus forecasts of 51.6. The Caixin manufacturing PMI also showed a slight expansion in December and improvement on the previous month, increasing to 50.8 from 50.7.

Markets extended their gains in December, with growing investor belief in a ‘soft landing’ for economies after the current rate cycle, particularly in the US, closing out an impressive year for risk assets. Australian equities were the top-performing asset class in December, returning 7.2% in the month, while developed international equities performed more modestly, returning 3.9% in hedged Australian dollar terms. The current atypical positive correlation between equities and bonds continued in December, with falls in government bond yields across the globe generating strong returns for fixed interest asset classes as well. Despite war in the Middle-East and OPEC+ production cuts, the price of West Texas Intermediate Crude Oil slid again for the third straight month, by 5.7% this month and -21.1% for the quarter, in what is a simple case of surging supply (namely from the US and Russia), against a backdrop of weakened global demand (especially China). However, the looming threat of conflict in the Red Sea affecting trade routes would also have substantial impact on oil prices and goods prices more broadly.