Investment update - February 2024

Market update

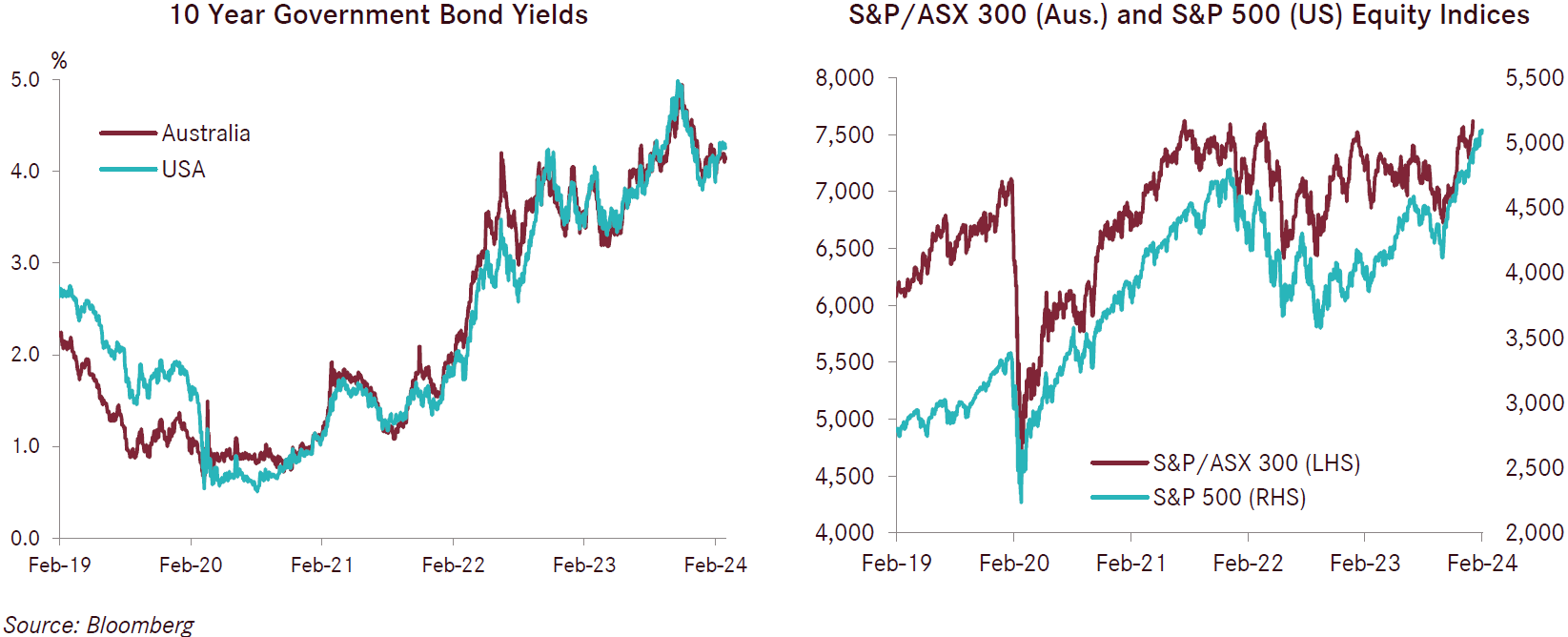

Global share markets were very strong in the month of February, with developed international shares up 5.9% on an unhedged basis in the month alone, bringing 12 month returns up to 30%. Australian shares also enjoyed a solid month with a gain of 1% and are now 10.5% higher over 12 months. The strength of international shares continues to be led by US equities and Japanese equities, though over the course of February this broadened with strong gain.s coming from Germany (DAX was 4.6% higher) and French equities (CAC up 3.5%). Fixed income returns were negative over the month of February as yields moved higher, delivering a return of -0.8% for international fixed income and -0.3% for Australian fixed income.

The robust returns for equities were underpinned by improving leading economic indicators and easing financial conditions. Strong earning announcements out of the US also helped move markets higher. Inflation surprised on the upside in the US and has now increased three months in a row and when combined with a strong labour market, is forcing bond markets to question whether there will be as many interest rate cuts in 2024 as previously thought. European inflation continued to moderate with CPI falling to 2.6% over the year to end February which was slightly above market expectations of 2.5%. In the UK, inflation was unchanged in January with annual rates continuing at 4% year over year, however this was welcomed by markets as it was below expectations of 4.2%. Inflation in Australia registered at 3.4% for the 12 months to end January, below expectations of 3.6%.

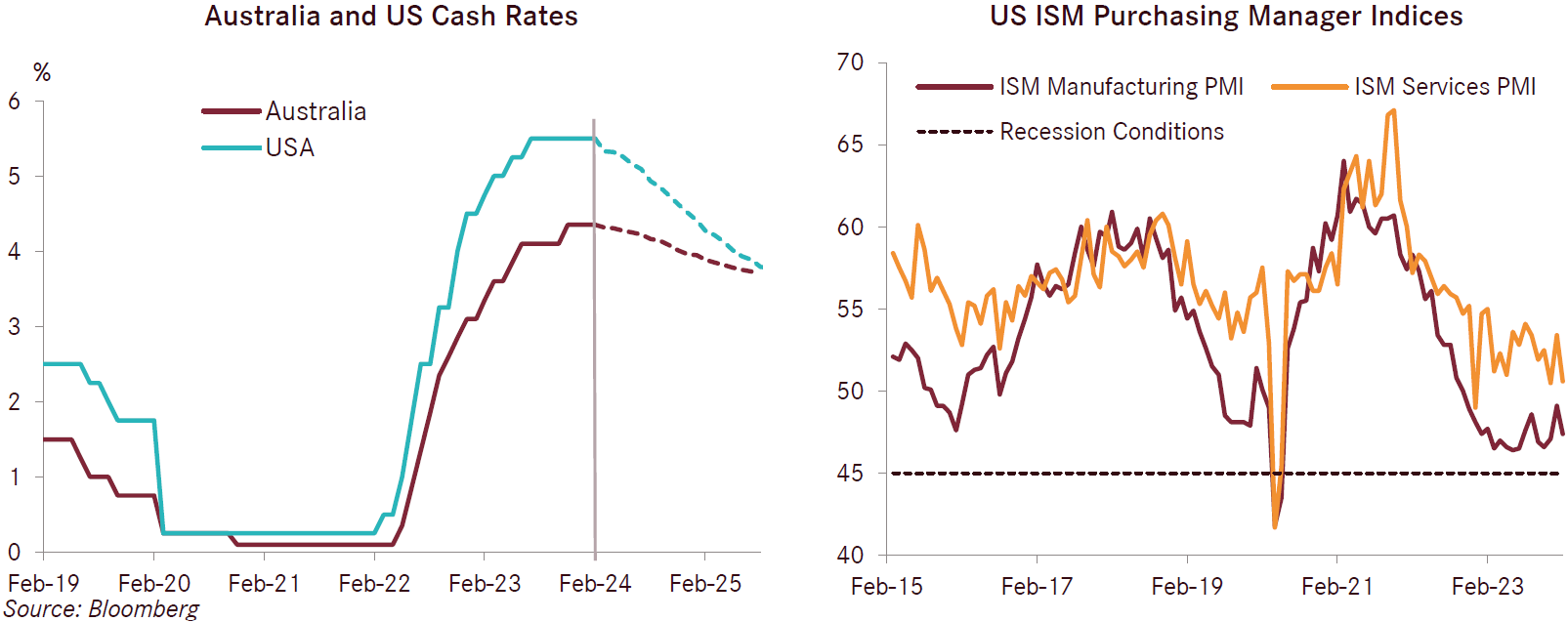

While there is considerable variation in inflation rates between countries, good progress across the board has been made with reducing inflation back towards central bank targets. That said, levels of inflation for many developed economies remain well above central bank targets. When combined with improving economic leading indicators and easing financial conditions, markets are progressively pricing in fewer interest rate cuts from central banks over the course of 2024.

Recent data released for Australia covering Q4 2023 shows an economy that has slowed significantly, with real GDP coming in at 0.2% for the quarter and 1.5% for the year to end December. This soft number was largely expected by economists and reflects a broad weakening of the economy. A softening labour market with a noticeable reduction in hours worked, declines in goods imports and exports, and soft survey data coming from companies, shows the weakness is being felt widely across the economy. Given the strong population growth of nearly 2.5%, the soft GDP result shows that without the strong immigration, GDP would have been much weaker.

Business confidence softened further with the NAB Business Conditions Index conditions falling 2 points to a level of +6 points in January and is now running just below long-term average levels. Monthly falls in trading conditions, profitability and employment were driving the softening business environment. In level terms, profitability and trading conditions are below longterm average levels while employment remains above its long-term trend. Australian consumer sentiment as measured by the Westpac Consumer Sentiment Index improved by +5 points up to a level of 86 points and above recent lows, and it is now at a 20-month high. The improving sentiment is broad based and driven by cooling inflation flowing through to increased expectations of interest rate cuts while also being supported by recently announced personal income tax cuts.

The data out of the US economy continued to be robust. December quarter GDP came in at 3.2% and was 2.5% over the year to end 2023. The increase in GDP was driven by consumer spending, non-residential fixed investment, government spending (at all three levels of local, state and federal) and exports. Payrolls increased by 311,000 in February, which was higher than expected, and while the unemployment rate increased to 3.6%, this was driven by a slightly higher participation rate. The labour market in the US remains strong. Consumer spending, which accounts for approximately two thirds of the US economy, increased by 3% over the 12 months to end December, and helped underpin strong domestic demand. US ISM manufacturing data surprised to the downside, coming in at 47.8 in in January, down from 49.1 in December and below 49.5 expected. US ISM services data increased to 53.4, showing faster growth in the services sector within the US over January. The prices component of this index accelerated considerably, up +7.3 points to 64 and will be carefully watched by markets in coming months.

Inflation in February was higher than markets were expecting and resulted in markets changing their expectations of the commencement of interest rate cuts from March to June. Bond markets were pricing as many as six interest rate cuts or 1.5% over the course of the 2024 prior to this data - after the strong inflation data this has been pulled back to 1.0%. The US Federal Reserve continues to hold the policy rate at 5.25% - 5.5%, and this is likely to continue for the next few months. If inflation increases further or even remains at current levels, markets will likely expect even fewer interest rate cuts, which in turn would lead to higher interest rates. This scenario remains a key risk factor for asset markets over coming months.

In the Euro Area, GDP for the fourth quarter of 2023 came in at 0% and was up from -0.1% in the third quarter. Over the year to end December 2023, Euro Area GDP grew by 0.1%. Most leading indicators for the Euro Area remain depressed in level terms though some are showing recent signs of improvement. The HCOB Eurozone Manufacturing PMI came in at 46.5 and was the second slowest reading in manufacturing since March 2023. Outcomes were uneven across countries with Germany showing the weakest data while slower deterioration was recorded for Netherlands, Italy and France, and growth for Spain, Greece and Ireland. Eurozone Services PMI increased to 50 in February and was the strongest result in six months. Consumer confidence in the European Union tells a similar story of being at depressed levels, though is showing clear signs of improvement with the European Commission index of Consumer Confidence increasing to -15.8 points in February, the best reading in the last 12 months.

Inflation continues to moderate for the Eurozone with CPI slowing to 2.6% year on year to February, though this was slightly ahead of expectations of 2.5%. Core CPI slowed to 3.1% over the 12 months to end February, though was also higher than expectations of 2.9%. With stubborn inflation, expectations of near-term interest rate cuts from the ECB have been pushed back and the European Central Bank (ECB) is likely to continue holding its cash rate at 4% for a while longer yet.

The S&P Global UK Manufacturing PMI came in higher at 47.5 in February, the highest in 10 months, though it remains at a level that signals contraction in this sector. The services PMI came in at 54.3 in February, matching January, and the best monthly performance in eight months. Improved business and consumer spending along with easier financial conditions are supporting a more confident services sector. UK inflation surprised to the low side in January and came in at 4% against expectations of 4.2% for the year to end January. While a welcome result, inflation remains double the Bank of England’s target level and therefore interest rate cuts are also likely to be in the second half of the year rather than the first. The Bank of England Governor, Andrew Bailey, recently said that the markets expectations for cuts this year were not unreasonable, however.

China’s economic data improved moderately over the course of February with NBS manufacturing and services sector surveys improving slightly to 50.9 and 51.4 respectively. China continued to experience deflation with inflation falling to -0.8% for the 12 months to end January, marking four consecutive months of deflation. The Chinese leadership stated its growth target of 5% in real terms for the country in 2024, an optimistic target given the current soft economy. Not withstanding considerable fiscal and monetary policy easing already injected into the Chinese economy over recent months, markets are expecting further stimulus measures to be announced in the near future.