Investment update - January 2024

Market update

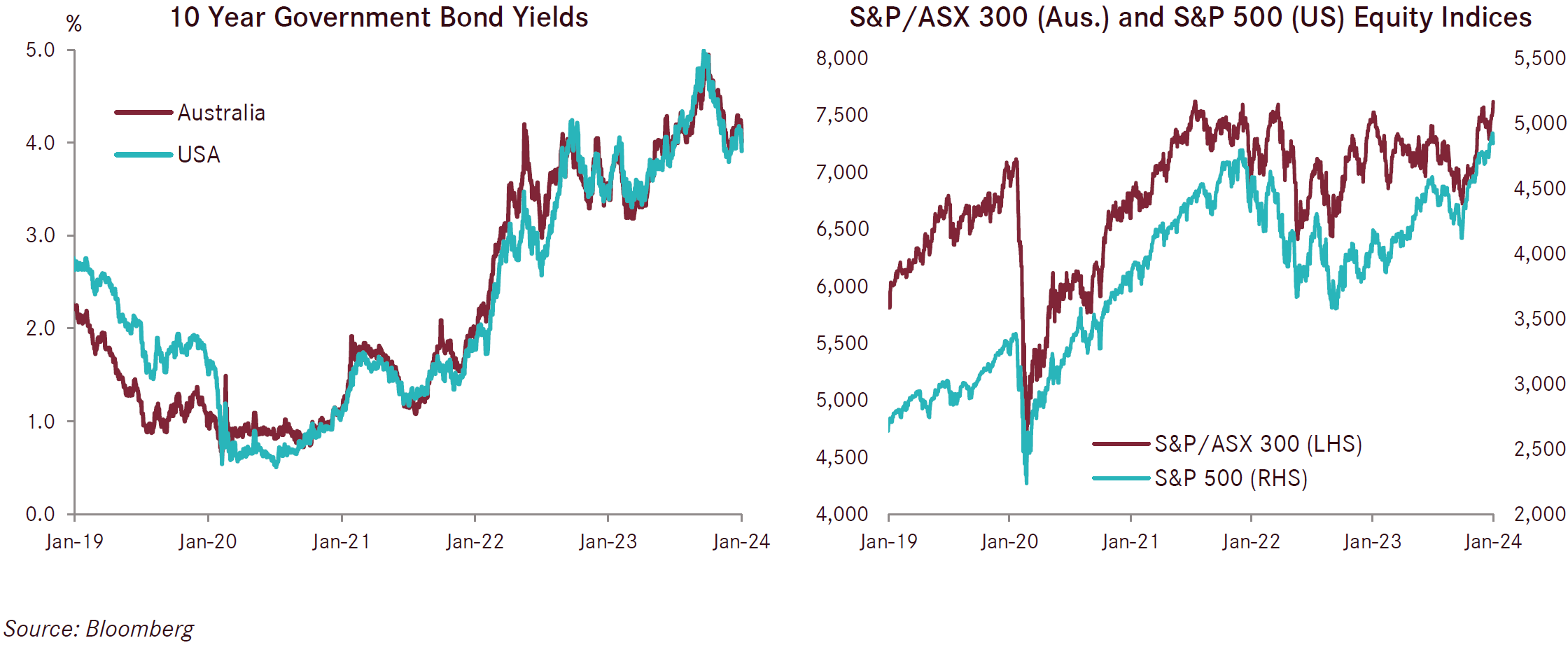

The strong finish to the year for share markets continued into the month of January with Australian and developed international equities (hedged in Australian dollar terms) returning 1.1% and 1.8% respectively. These gains were driven significantly by solid economic data combined with easing inflation (particularly in the US), resulting in markets pricing in more interest rate cuts for 2024. While interest rate cuts are not always a good thing as they often occur when there is economic weakness, in the case of the US, the economy is holding up well with the unemployment rate remaining low and economic activity robust.

The combination of falling inflation with a strong economy is most evident in the US. In most European countries, economies are much softer as the combination of higher interest rates and economies still transitioning from the fallout of the Russian/Ukraine war both unfold. Inflation in the United Kingdom and most European countries remains at levels above central bank targets, so while moderating prices are welcome, central banks are signaling that higher interest rates are likely to remain until they are confident that inflation has moderated further before they commence reducing cash rates.

The conflict in the Middle-East has escalated further as US and UK armed forces engage with the Iran backed Houthi Rebels in Yemen and other militias in the region. This escalation follows further attacks on military targets as well as cargo ships transiting the Red Sea. Shipping costs have increased considerably since the Hamas/Israel conflict began with many shipping companies choosing not to sail through the conflict zone. While financial markets have not been too concerned with these deteriorating conditions, the potential for further increases in oil prices and upwards pressure on inflation remain high. If this was to eventuate it could force central banks to leave interest rates higher for longer and in turn could put pressure on asset prices.

In Australia, inflation continues to moderate, though remains higher than that seen overseas. Markets continue to price an expectation that official cash rates won’t increase any further and are likely to start falling in the second half of calendar 2024. Higher interest rates are being felt across the Australian economy through higher mortgage rates and are consequently hurting consumers with loans. Australia’s September quarter real GDP moderated to just 0.2% and was 2.1% over the 12 months to September 2023. GDP per capita declined by 0.3% over the year to September 2023, showing that the large increase to immigration in recent years has helped Australia avoid a recession.

Business conditions continued to moderate in December with the NAB Business Survey seeing conditions fall by 2 points to 7 points. While conditions eased, they remain at levels around long-term average. In terms of sectors, manufacturing, retail and wholesale remain noticeably soft, led by cautious consumers. Recently, proposed cuts to tax rates, particularly the lower tax brackets, are targeted to provide fiscal support for Australians feeling cost of living pressures, and if passed in parliament, should provide some much-needed support to consumers.

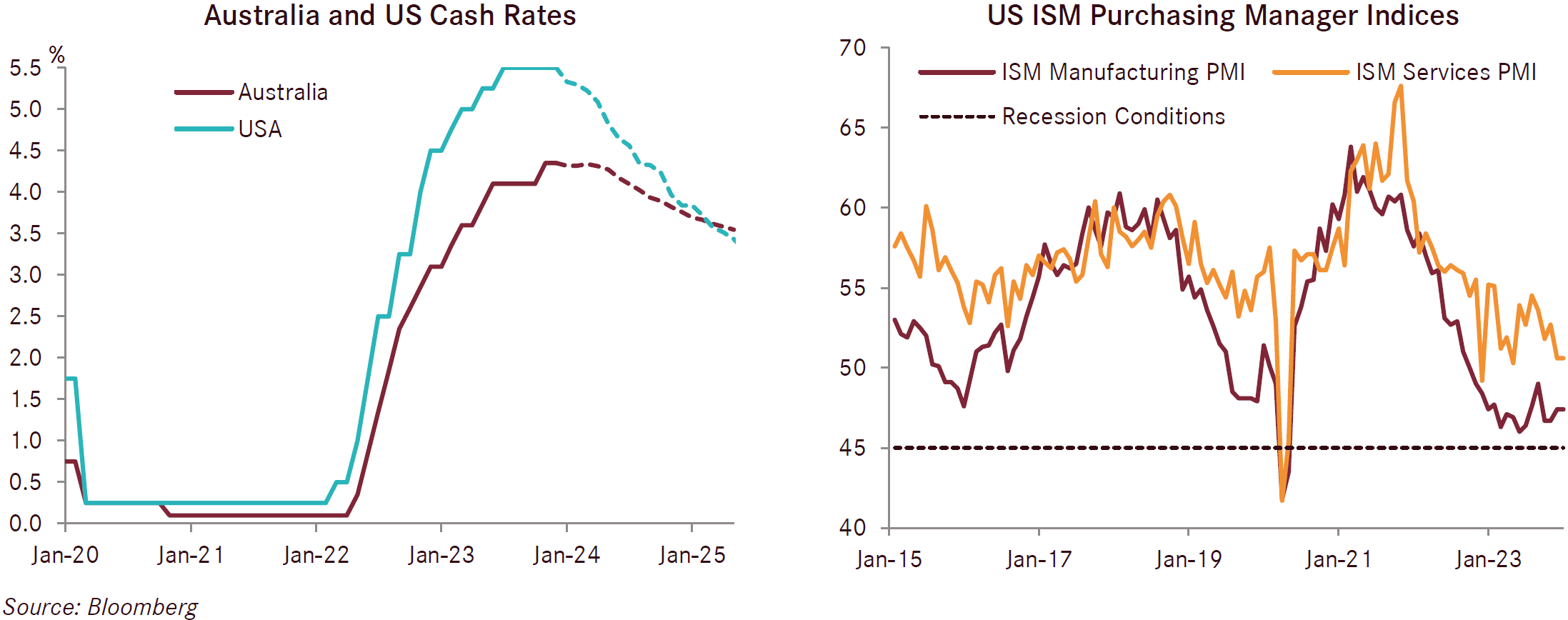

In the US, the annual inflation rate rose to 3.4% in the year ending December, up slightly from 3.1% in November, though inline with expectations. The producer prices measure of inflation was just 1% for the year to December 2023. Producer prices are typically seen as a pre-cursor to consumer prices as they reflect the input costs of producers. Given that there has now been three months in a row of negative monthly producer price changes, there are growing expectations that inflation is likely to continue to moderate. The US Federal Reserve continues to hold the policy rate at 5.25% - 5.5% and this is likely to continue for the next few months. Markets are pricing in more than 1% of interest rate cuts by the Federal Reserve over the course of 2024. While this is entirely possible, this is not what the Federal Reserve is communicating, and the path of interest rates over the course of the year will have large impacts on asset prices.

The US economy continued to deliver strong outcomes, led by a strong labour market where the US unemployment rate remains unchanged at a low 3.7%. Total nonfarm payroll employment increased by a huge 353,000 in January, nearly double the number that was expected. GDP increased by 3.1% in real terms over the course of calendar 2023, another solid result. Survey data such as the US Purchasing Manufacturing Indices have also turned higher having spent a considerable part of calendar 2023 in contraction territory. For January, the headline PMI increased to 50.7 from 47.9. A key driver supporting the strength in the US economy is the very large fiscal deficit that the US Federal Government is running. Over the course of 2023, the US Government ran a deficit of some US$1.7 trillion dollars. With an election year in 2024, the likelihood of a reduced budget deficit is low, leading to markets expecting ongoing strength in the US economy.

In Europe, the European Central Bank (ECB) left the deposit rate unchanged at 4% at its January meeting. While the accompanying statement acknowledged progress in bringing down inflation toward its target, the ECB maintained its “data dependent” approach, essentially looking for further confirmation that inflation has been brought under control with its current monetary policy settings. In particular, the European wage price data due for release in March 2024 is likely to be an important consideration in determining the timing of rate cuts in 2024, especially given weak economic growth; expectations for economic growth in 2023 are approximately 0.5%. In the UK, the ongoing sluggish economic growth of 2023 continued with GDP of just 0.3% over the 12 months to end September and expectations for the 12 months to end December are around 0.5%. While this is weak, it is better than forecasts which started 2023 for a contraction of 1.0% and a recession. Inflation in the UK remains stubborn and increased unexpectedly to 4% in the 12 months to end December compared to forecasts of 3.8%. Official cash rates in the UK are expected to remain on hold until the second half of the year.

China’s economic data continues to paint a picture of a soft economy. Critically, deflation has continued for three months in a row with -0.3% being recorded in December. Chinese GDP came in at 5.2% in December for the 2023 calendar year, slightly below expectations of 5.3%. Chinese authorities continue to announce further stimulus packages (both fiscal and monetary) to try and stimulate the economy, though are clearly reluctant to announce building related stimulus packages including property or infrastructure, as they would like to see a more consumer and demand led economy. Recent cuts to the amount of capital banks needs to hold (reduced by 0.5%) should promote more lending and economic activity. China’s property market is going through a tumultuous period with property developers continuing to default. In late January, Evergrande, China’s largest property developer, was given orders from Hong Kong’s High Court to commence liquidation, removing hopes of a bailout from the Government. Evergrande has approximately US$300 billion in outstanding debt. Optimism remains low on financial markets with Chinese shares falling to multi year lows early in calendar 2024.

Overall, inflation has moderated considerably over the course of the past 12 months and most economies have held up better than expected in light of the higher interest rate environment. Going forward, markets are pricing in numerous interest rate cuts while assuming that economies will escape without entering recession. The economic data validates this pricing and thesis at the end of January. That said, risks remain numerous and possible stubborn inflation (and with it, higher interest rates), weakening economies off the back of higher interest rates, and geopolitical risks all need to be navigated in the year ahead.