Investment update - July 2024

Market update

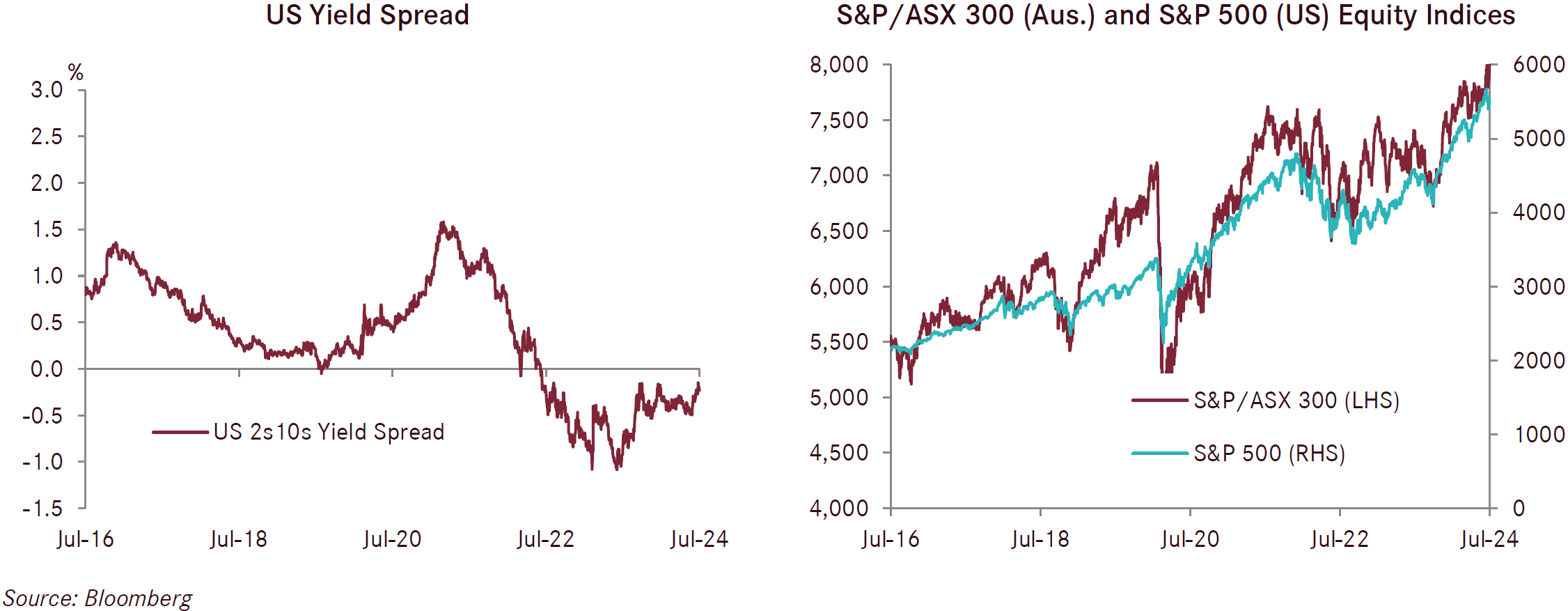

The US S&P 500 increased in July by 1.1%, continuing its very strong run over the last 12 months. There was some broadening out of the gains in the US market away from the technology sector which has been heavily driven by the AI theme. Developed international shares (hedged) rose by 1.2% for the month. Unhedged international shares were a lot stronger, increasing by 4.1% in July, driven mainly by falls in the Australian dollar, which increased the value of international shares for Australian investors. In local currency terms, Australian shares were the standout performer, with a 4.1% monthly return. European markets were also positive over July with the German DAX up 1.5%, the French CAC up 0.7% and the UK FTSE 2.5% stronger. Initial concerns from the early results of the French election, which suggested the potential leadership of the far right led by Marine Le Pen, dissipated as a hung parliament scenario eventuated.

Economic trends across the world largely continued in July though the pace of softening of US data accelerated. Markets remain focused on the US election in November and the withdrawal of President Joe Biden and the Democratic Party nomination of Kamala Harris has changed the landscape of the election. US inflation was lower than expected and markets continued to increase their expectations of multiple interest rate cuts from the US Federal Reserve over the remainder of 2024 with the first rate cut now seen in September. European data was typically better than expected in July though results were mixed with German data softer than most other countries. Prior to the market ructions in August, the Japanese share market sold off in July and was down 1.2% in local currency terms for the month after a very strong year and elevated valuations, combined with growing expectations of higher interest rates to defend a very weak Japanese Yen, building concern for investors.

Fixed income asset classes were positive over the month as yields fell in most markets, pushing returns higher. International fixed income increased by 1.9% and Australian fixed income returned 1.5% for the month of July.

The Australian consumer remains in a weak position as measured by the Westpac Melbourne Institute Consumer Sentiment Index which increased 0.3% in June though in absolute terms is at a level of 82.7 points, and is consistent with widespread pessimism and consumer concern. Of note is the considerable increase in concern among Australian consumers of possible further interest rate increases from the RBA. In the June survey reported by Westpac, 60% of consumers expect an interest rate increase over the next 12 months based on the Mortgage Rate Expectations Index.

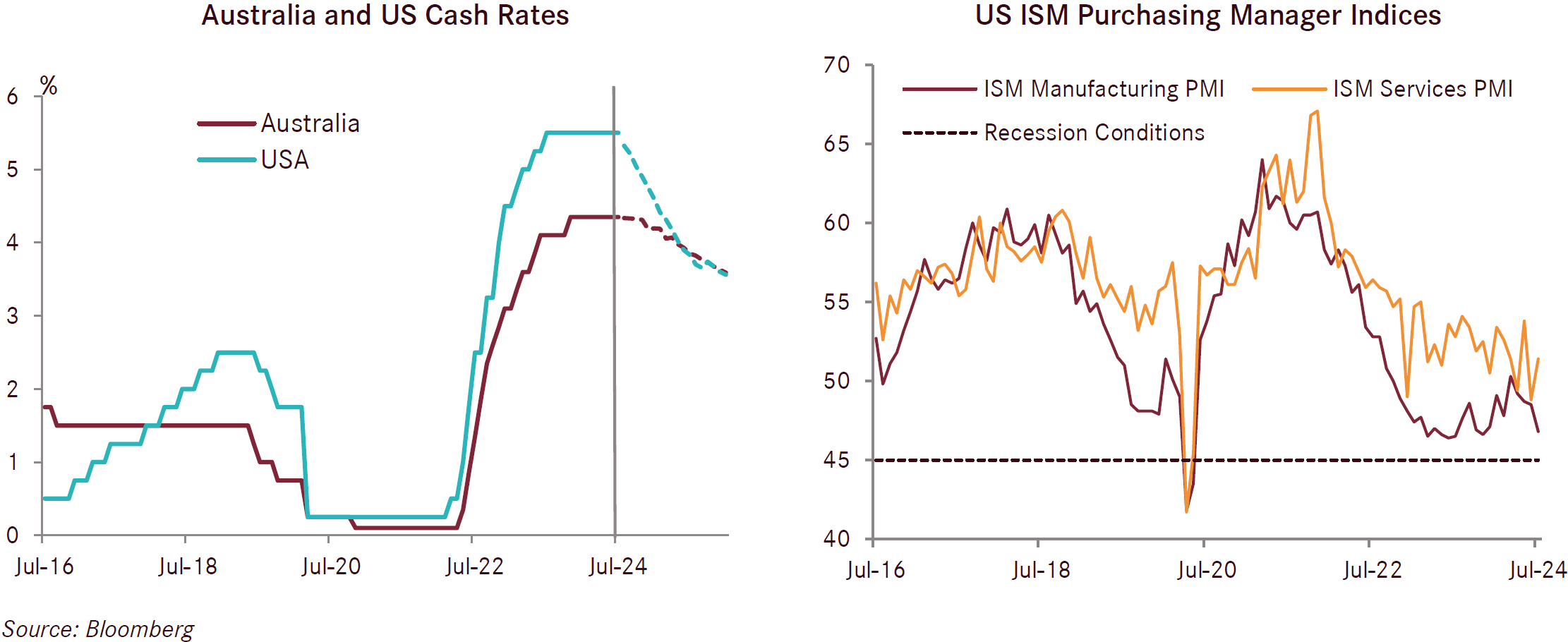

June quarter inflation data from the Australian Bureau of Statistics published at the end of July gave markets some relief to concerns of an imminent further interest rate increase. Headline inflation came in as expected at 3.8% over 12 months to end June though core inflation was a touch stronger than the RBA was expecting at 3.9% over 12 months versus 3.8% expected. Many market participants were forecasting inflation results higher than the RBA. Leading up to these results there was pressure on the RBA to increase rates to reign in inflation that had been trending higher for much of the year so far. Fixed income markets had a 20% chance of a rate hike at the RBA’s August meeting prior to the inflation release and markets are now pricing no further rate hikes from the RBA. However, it is too early to call a peak in the Australian cash rate given inflation data remains well above the RBA’s top end of its target range. The most widely expected outcome now is a “hawkish hold” from the RBA, whereby they don’t increase rates though continue to remain concerned about elevated inflation and remain data dependent while they give more time for inflation to moderate.

Australian business confidence softened in June with the NAB Business Conditions Index decreasing 5 points to a level of +5 points. The business community continues to share similar concerns to those seen in the consumer sentiment surveys with weakness in the housing sector and higher interest rates hurting confidence alongside soft economic growth. US inflation was again softer than expected in June with headline CPI 3% year-on-year versus 3.1% expected. Core Personal Consumption Expenditure Inflation, a preferred measure of the US Federal Reserve, came in at 2.6% for the year to end June and was only slightly above the consensus estimate of 2.5%. Further softening in some US leading economic data alongside subdued inflation outcomes has seen a considerable increase in expectations of interest rate cuts from the US Federal Reserve with the first cut expected in September.

The US ISM Services PMI rebounded from its fall in June, to increase from 48.8 to 51.4 in July. The rebound was driven by increases in business activity and new orders, though the latter remains relatively weak. The manufacturing index fell for the fourth month in a row, down 1.7 points to 46.8 in July, with falls in production, new orders and employment leading the declines. Payrolls increased by just 114,000 in July, the lowest level in three months, and considerably lower than the average of 215,000 per month seen over the prior 12 months. Initial jobless claims continued to increase slightly in July, though were in line with expectations. The combination of recent weakness in the ISM indices alongside considerable weakening of jobs growth has some market participants concerned that a US recession could be ahead.

Following the European Central Bank’s 25 basis point rate cut in June which brought cash rates down to 3.75%, markets are now expecting an extended period of cash rates being on hold. Headline inflation moved higher, increasing to 2.6% over the 12 months to July, ahead of expectations of an increase of 2.5%. Core inflation also was a little higher than expectations remaining flat at 2.9% over 12 months to end July versus expectations of a decrease to 2.8%.

The Conference Board’s Leading Economic Indicator for the Euro Area declined by 0.8% in June down to 97.5, while the Conference Board’s Coincident Economic Index remained unchanged at 108.7. The HCOB Eurozone Manufacturing Index decreased to 45.8 in June, down from 47.3 and was driven by contraction in output with new orders, purchasing activity and employment all declining at a faster rate. The services sector also slowed, falling to 50.9 in June and is at a 3-month low. While still expanding, the survey cited softening demand with a reduction in new orders and weaker sales performance, particularly in relation to exports. The European Commission consumer confidence index rose by 1 percent and continues its steady improvement over the calendar year to date. The services sector is of particular importance to the Euro Area as approximately 75% of GDP and employment across Europe comes from the services sector.

Flash PMI UK economic survey data from S&P Global increased slightly in July, rising to 52.7 from 52.3. Both services and manufacturing indices increased at faster rates with manufacturing at a 29-month high. Strong private sector growth resulted in firms increasing staffing numbers at the quickest rate in in 13 months. Manufacturing survey respondents cited high production levels supported by stronger order books. Services businesses had a notable increase in new work compared to June. The Bank of England (BoE) cuts its cash rate by 0.25% to 5% at its August meeting. The decision to cut interest rates was a 5 to 4 decision from the voting members, so only narrowly got through. The message post the decision was one of cautiousness going forward and with future decisions being data dependent. This means that a further reduction in inflation is required before the BoE will cut again.

China’s economic data continued to paint a picture of a soft economy. GDP grew at just 0.7% in Q2 of 2024, driven by bad weather, soft consumer consumption and retail sales alongside ongoing property weakness. Core inflation fell further with a deflationary print of -0.1% in June. Headline inflation fell to 0.2% and was well below consensus expectations of 0.4%. Retail sales fell by 0.1% in June and is also reflected in soft consumer confidence. The ongoing transition to a low growth, consumption led economy from a highly indebted starting point is proving challenging. Multiple fiscal and monetary easing announcements have not yet had any meaningful impact. The Chinese 10-year bond yield fell to an all time low of 2.1% recently, a sign that bond markets believe the economic data will continue to deteriorate. The Caixin China General Services PMI rose to 52.1 from 51.1 in July and was ahead of market expectations while the Caixin China General Manufacturing PMI decreased to 49.8 in July, below market expectations of 51.5.