Investment update - June 2024

Market update

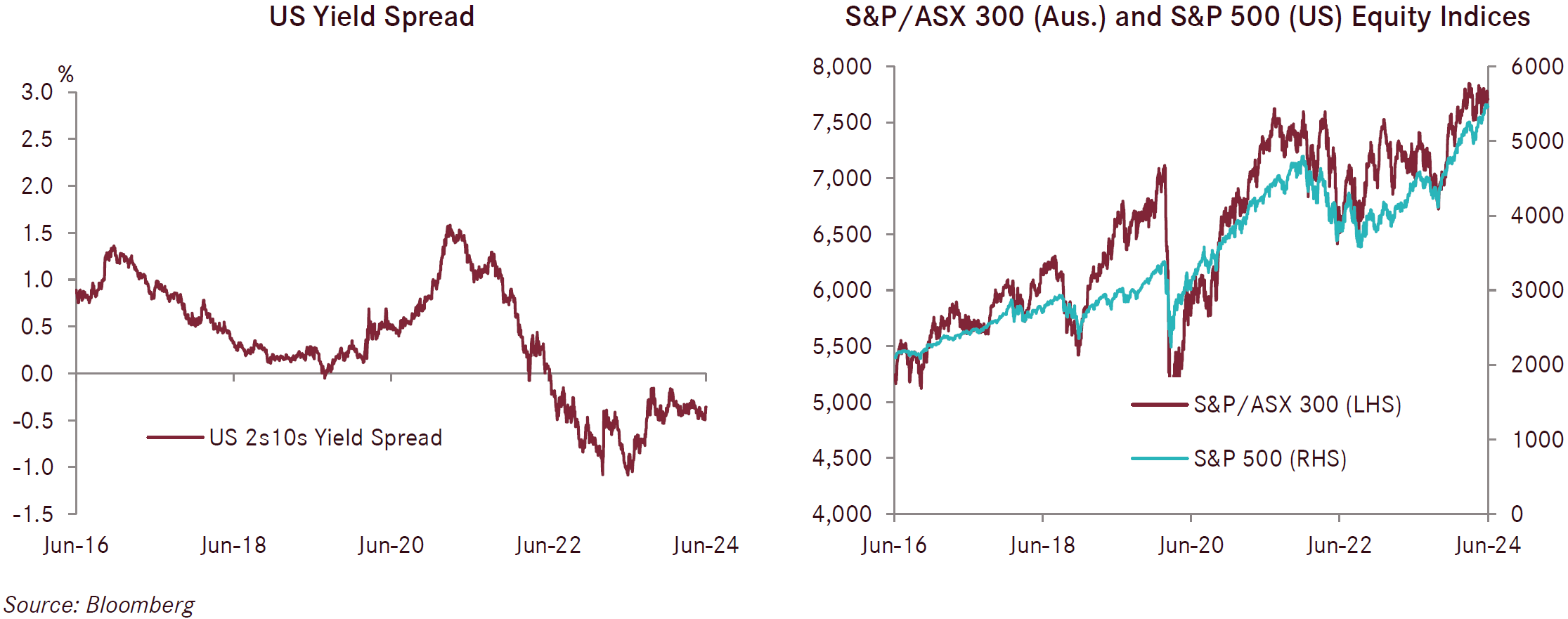

The US S&P 500 had a solid performance in June increasing by 3.5%, chalking up a remarkable 22.7% return for the financial year. The impressive performance was driven by ongoing strength in the technology sector and in particular companies exposed to the predominant AI theme. Developed international shares (hedged) rose 3.0% for the month and was up 20.2% for the year. The strong performance of international shares was led by the S&P 500 as the US share market makes up approximately two thirds of the international shares index. Australian shares performed well with a 0.9% monthly return and were up 11.9% for the financial year. European markets struggled in June as the surprise French election results have seen a large unexpected swing away from the incumbent centrist party led by Emmanuel Macron to the far right led by Marine Le Pen. Concerns around a hung parliament and the possible implementation of extreme policies that would further pressure the fiscal position and the already heavily indebted French Government balance sheet resulted in yields moving higher and equities selling off sharply. For June, France’s equity market returned minus 6.4% on a local currency basis. The weakness spilt over to other European markets with the German DAX index down 1.4% and the United Kingdom’s FTSE off 1.5% in local currency terms in June.

Overall, equities had a very strong 12 months, notwithstanding ongoing geopolitical uncertainty, military conflict in Ukraine and Gaza, tighter monetary policy conditions from higher cash rates, and ongoing concerns of cash rates not coming down as quickly as first hoped. Most of these concerns have not been resolved and are carried into the new financial year.

Fixed income asset classes were positive over the month as yields fell in most markets pushing returns slightly higher. Both international and Australian fixed income assets returned 0.8% for the month of June. Over the 12 months to end June, Australian fixed income returned 3.7% and international fixed income returned 2.7%, both below the return from Australian cash of 4.4%.

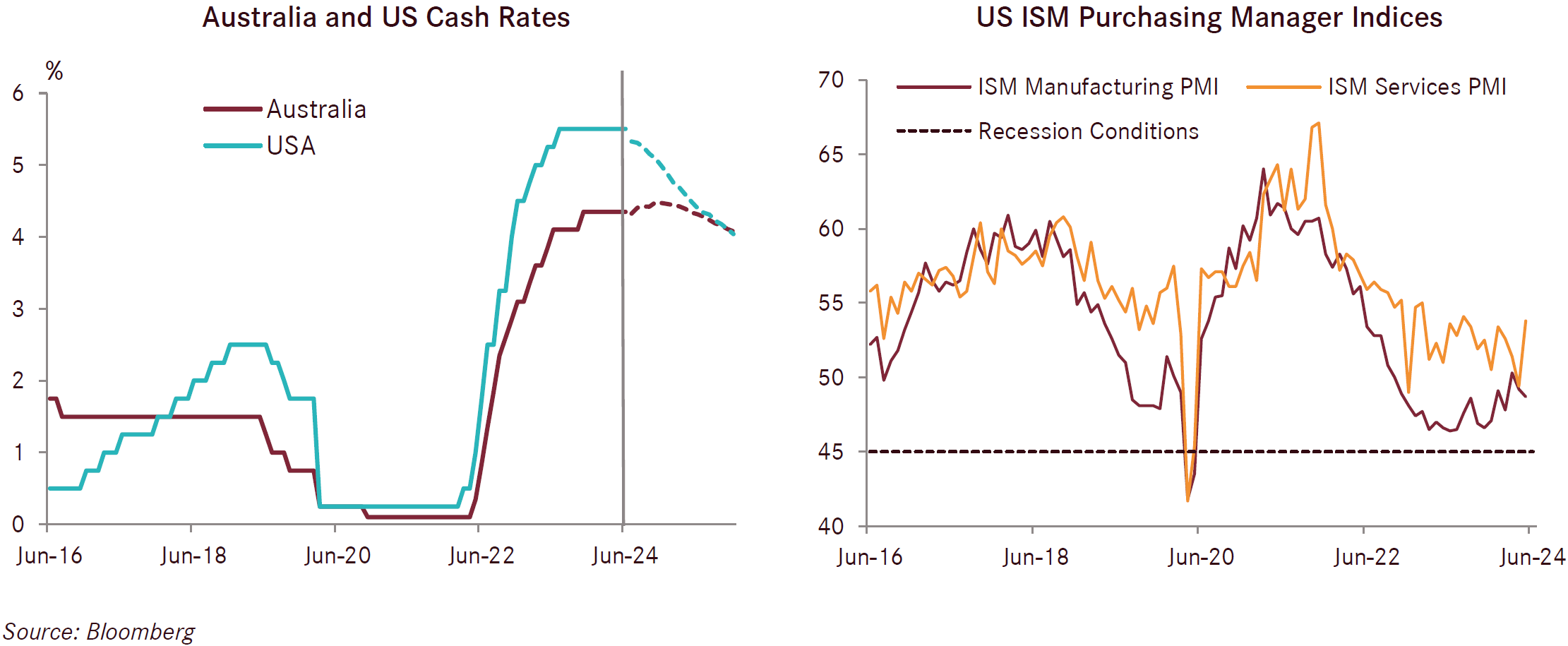

The Australian consumer remains cautious as measured by the Westpac Melbourne Institute Consumer Sentiment Index which dipped 0.3% to a level of 82.2 points for May. Ongoing cost of living and inflation concerns weigh heavily on the mind of the domestic consumer, however, tax cuts and cost of living relief measures coming into effect in July will help somewhat with the diminished confidence. The RBA kept the official interest rate at the current level of 4.35% at its June meeting though it retained its concerns around persistently high inflation. Australian inflation was 4% for the year to end May, higher than the 3.8% expected by markets. This surprise inflation print came out after the RBA June meeting and has resulted in markets pricing in a 30% chance of an interest rate hike at the RBA’s next meeting in August. Even if an interest rate increase is not delivered, leaving current rates on hold for a longer period is not the news consumers with large mortgages are wanting to hear.

Economic data released through June suggests Australia’s economy is softening. The Westpac Melbourne Institute Leading Index fell slightly in May suggesting that the Australian economy was tracking slightly below trend over the second half of the financial year. The impact of higher interest rates and the discussion of possible further rate rises, along with lower commodity prices and a weak outlook for housing, is dragging on the domestic economy. Australian business confidence softened in May with the NAB Business Conditions Index decreasing 1 point to a level of +6 points, just below long-term average levels. The business community shares similar concerns to those seen in the consumer sentiment surveys with weakness in the housing sector and higher interest rates hurting confidence.

After several months of stronger than expected inflation data readings in the US, the May inflation result was slightly softer than markets were anticipating (headline CPI was 3.3% year-on-year in May versus 3.4% expected). Of critical importance is the Fed’s preferred measure of Core Personal Consumption Expenditure Inflation which fell to 2.6% for the year to end May and below the consensus estimate of 2.8%. This reduction in inflation will be welcomed, however it will need to be supported with further soft inflation data before the US Federal Reserve can commence cutting interest rates. The US Congressional Budget Office provided an updated projection for the US Government’s deficit that was US$0.4 trillion higher than its forecast in February and is now US$1.9 trillion for the year ending September 2024. The forecast for ongoing structural deficits is concerning given the elevated level of government debt and will present a considerable challenge for the US economy at some stage.

The US ISM Services PMI increased in May to 53.8, the best reading in nine months and above forecasts. The manufacturing outlook was not as strong though, with the US ISM Manufacturing PMI falling in May, with the index down 0.5 points to 48.7. Payrolls increased by 272K in May, which was well above expectations of 185K, and follows a disappointing 165K figure in April. This job growth continues to be led by the health care sector. The November US Presidential election will progressively become more of a focal point for financial markets particularly around policy proposals and those relating to potential new tariffs that could amplify already heightened trade tensions.

The European Central Bank’s 25 basis point rate cut was delivered in the first week of June, bring rates down to 3.75% and was widely anticipated. Given the ECB raised its headline inflation forecasts for 2024 and 2025, the market has taken this step as a “hawkish cut”, with Eurozone bond yields slightly rising afterwards. Another development has been the 2024 European Union elections held in early June, which has seen the rise of far-right nationalist parties at the expense of centrist groups. In France, Marine Le Pen, the leader of the far right, has gained considerable popularity and may well end up securing enough votes to be successful in appointing the Prime Minister. Additionally, Green Party politicians ceded a significant number of seats, potentially a threat to the continued implementation of the EU’s Green Deal worth 1.8 trillion euros.

The Conference Board’s Leading Economic Indicator for the Euro Area declined by 0.5% in May, to a level of 98.2, while the Conference Board’s Coincident Economic Index increased marginally to 108.7. The HCOB Eurozone Manufacturing PMI rose to

47.3 in May from 45.7 in April, which is the highest reading in over a year, and indicating a potential turnaround in the health of the Eurozone manufacturing sector. While manufacturing remains subdued, the services sector continues to show ongoing signs of strength with the HCOB Eurozone Services PMI falling only marginally to 53.2 in May from 53.3 in April. The services sector, which makes up approximately 75% of GDP and employment across Europe is gaining momentum due to increasing demand and steady employment growth.

Flash PMI UK economic survey data from S&P Global suggests that economic growth is moderating, and that the UK second quarter GDP could be approximately 0.3%, half that seen in the first quarter. Survey respondents cited ongoing uncertainty in the business environment in the lead up to the general election resulting in firms delaying decisions until there is clarity regarding government policies. While the services sector is slowing, the manufacturing sector continues to improve, with increasing factory output and stronger new orders. The Bank of England (BoE) has kept interest rates on hold at 5.25% at its June meeting and markets are now expecting an interest rate cut in August, their next meeting. The BoE changed its messaging, describing the June decision to remain on hold as “finely balanced”. Further confirmation of ongoing moderation in inflation is being sought by the BoE, so inflation data over the next two months will be key as to whether the BoE cuts or not.

China’s economic outlook remains soft with cautious consumers and ongoing weakness in property markets, without a clear catalyst from the government to stimulate the economy in a meaningful way. Core inflation remains very low with prices just 0.6% higher in May compared to a year earlier. On the services side of the economy, the Caixin China General Services PMI decreased to

51.2 from 54.0 in May, as business confidence and the labour market weakened; this was its lowest level since October 2023. While a gloomy backdrop, not all data has been poor. The Caixin China General Manufacturing PMI increased slightly to 51.8 in June, up from 51.7 in April and surpassing market expectations of 51.2.