Investment update - March 2024

Market update

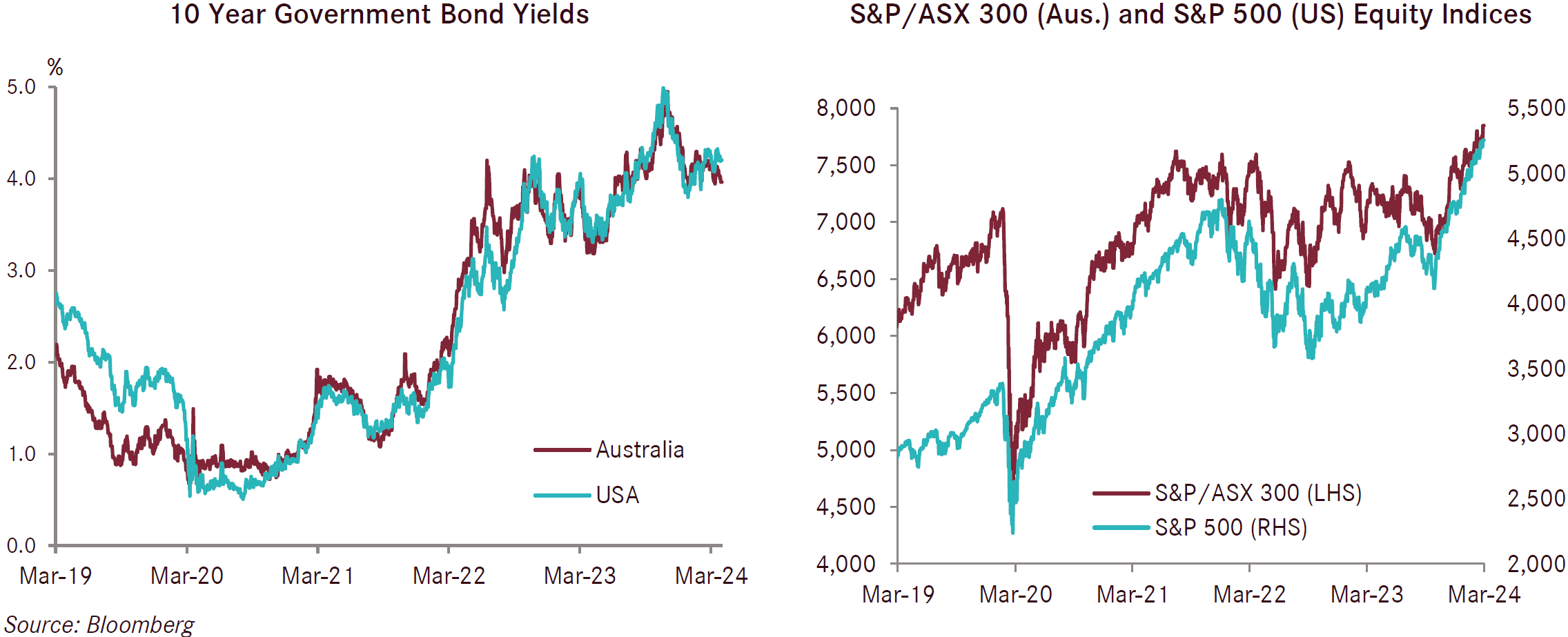

Share markets continued their very strong run in March, with both Australian shares and developed international shares (hedged) up 3.3% for the month. For the 12 months to end March, Australian shares are up 14.4% and developed international shares (hedged) are up 25%. The strength of international shares was broad based over the month, though the strongest markets were those in Europe with the German DAX 4.6% higher and the UK FTSE up 4.2%. Fixed income returns were also robust over the month as yields fell, resulting in returns of 0.8% for international fixed income and 1.1% for Australian fixed income.

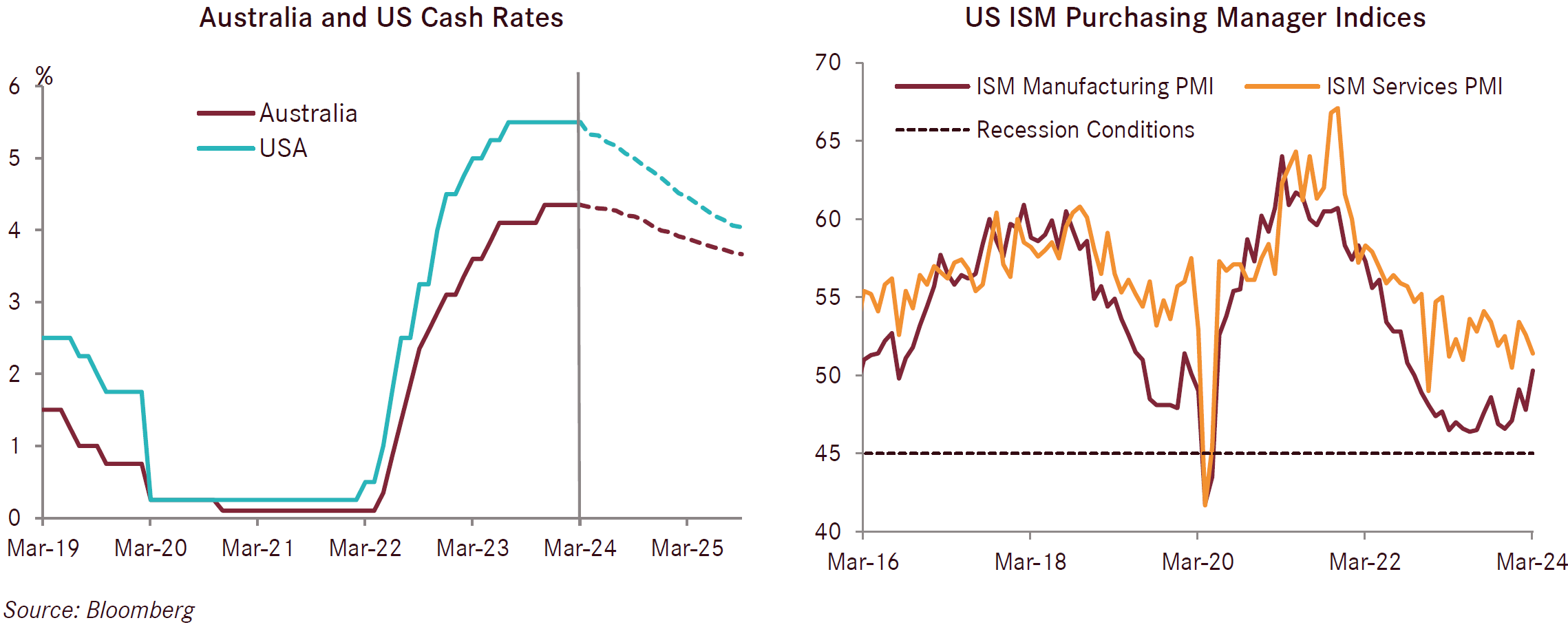

The drivers behind share markets for the US versus the rest of the world were slightly different in March. US equities were underpinned by ongoing robust economic activity while the higher-than-expected inflation numbers were met with a dovish narrative from US Federal Reserve Chair, Jerome Powell. Powell appears to be looking through short term strength in inflation readings and is maintaining his guidance for markets to expect near term interest rate cuts. US economic strength in key data releases and stronger than expected inflation is generally at odds with most other developed economies where moderate economic growth and disinflation is now more common. European inflation continued to moderate with CPI falling to 2.4% over the year to end March, which was slightly below market expectations of 2.6%. In the UK, inflation over the 12 months to end February fell to 3.4%, lower than markets were expecting, while inflation in Australia also registered below expectations at 3.4% for the 12 months to end February. The share markets of developed countries excluding the US have rallied in part due to increased expectations of cuts in cash rates supported by particularly dovish comments from the relevant central banks.

Markets have run hard in recent months, in part due to expectations of interest rate cuts occurring over the next six months. A key risk in the near term is inflation not moderating as quickly as expected, which in turn would likely force central banks to continue holding interest rates at higher levels.

The Reserve Bank of Australia kept the official interest rate at the current level of 4.35% at its March meeting. The minutes from the RBA meeting acknowledged that while demand in the economy outpaced supply, the demand side was falling quickly and that the current cash rate was appropriate. While the RBA hasn't increased interest rates nearly as high as many other developed nations central banks, it hasn't had to, as the economy is far more sensitive to movements in the official cash rate due to the very high proportion of consumer loans which are linked to the cash rate.

Australian business confidence improved in February with the NAB Business Conditions Index increasing 3 points to a level of +10 points and it is now running just above long-term average levels. Increases in trading conditions and profitability were somewhat moderated by flat employment conditions. The economy remains unbalanced at the sector level with retail and construction clearly soft while most services sectors are experiencing solid trading conditions. Australian consumer sentiment as measured by the Westpac Melbourne Institute Consumer Sentiment Index fell by 1.8% to a level of 84.4 points and while a step back from the month prior, it remains at levels well above lows seen over the past 12 months.

The US economy continues to outperform most of the developed world. The Atlanta Federal Reserve Bank estimates that US real GDP finished March at an annual rate of 2.8%. The US Services ISM Index remains solid with a reading of 51.4 in March, though this reduced from 52.6 in February. US Manufacturing ISM rose in March with the index up 2.5 points to 50.3, a level that is consistent with an expanding manufacturing industry. Payrolls increased by 232,000 in March, which was higher than expected, with most of the growth coming from the health care sector. The unemployment rate decreased to 3.8% in March, surprising markets with a stronger than expected result. Job vacancies in the US continued to fall with a total of 8.3 million vacancies in February, down 500,000 from the month earlier.

Markets will continue to watch US inflation numbers closely over coming months as signs of ongoing sticky inflation could force the US Fed to move to a more hawkish position going forward. Given asset markets have increased in price considerably in recent months, higher 10-year bond yields would have the potential to weigh on valuations. US presidential elections will be held later in 2024 and historically have been strong performing years for the US equity market, however. There are some growing concerns regarding the current large US fiscal deficit and highly elevated level of government debt combined with little apparent political willingness to put the budget on a more sustainable footing – this could also put considerable upwards pressure on interest rates.

Leading economic indicators were mixed for the Euro Area during February and March. The Conference Board leading economic indicator declined by 0.6% in February, following a decline of 0.8% in January. Falls in consumer expectations and manufacturing orders weighed on the results. Soft and deteriorating conditions for the manufacturing sector continued with the flash HCOB Eurozone Manufacturing PMI coming in at 45.7 in March, down from 46.5 in February. Offsetting this was growth in the much larger services sector, which makes up approximately 75% of GDP and employment across Europe. The HCOB flash Eurozone Services PMI increased to 51.1 in March, a nine-month high (up from 50.2 in February).

Inflation continues to moderate for the Eurozone with CPI slowing to 2.4% year on year to March and below market expectations of 2.6%. Core CPI slowed to 2.9% over the 12 months to end March which was also below expectations of 3.0%. The most recent reduction in inflation coupled with a more dovish ECB has resulted in markets expecting interest rate cuts sooner than previously thought, with a rate cut now 90% priced in for June.

The S&P Global UK Manufacturing PMI posted a strong improvement in March with a value of 50.3 in March, the highest in 20 months. The services PMI came in at 53.1 in March, and while a solid reading, this represented a decline from 53.8 in February. Survey respondents commented on challenging conditions for the UK consumer with respect to reduced disposable income which is squeezing demand, while underlying economic conditions were otherwise seen as improving. UK inflation surprised to the low side in March at 3.4% against expectations of 3.5% for the year to end March. The reduced inflation alongside a notably less hawkish tone from the Bank of England resulted in bond yields falling and market expectations of interest rate cuts arriving sooner than previously thought.

China’s economic data improved moderately over the course of March with the Caixin China General Manufacturing PMI increasing to 51.1 in March from 50.9 in February, which was slightly better than market expectations. On the services side of the economy, the Caixin China General Services PMI increased for the first time in three months to 52.7 in March, up from February's three-month low of 52.5 and was in line with forecasts. Chinese retail sales have effectively stalled with growth of just 0.03% in February and remains firmly in a downtrend. Breaking down retail sales by category shows that eating, drinking and entertainment sales remain solid, though sales related to housing remains very soft due to the ongoing weakness in the property market. Inflation returned in March with a result of 0.7% for the month of March after the previous four months of deflation. The ongoing deleveraging of the property market along with a desire from the government to see more of a consumer driven economy leaves China in a moderate growth scenario without further fiscal and monetary stimulus.