Investment update - May 2024

Market update

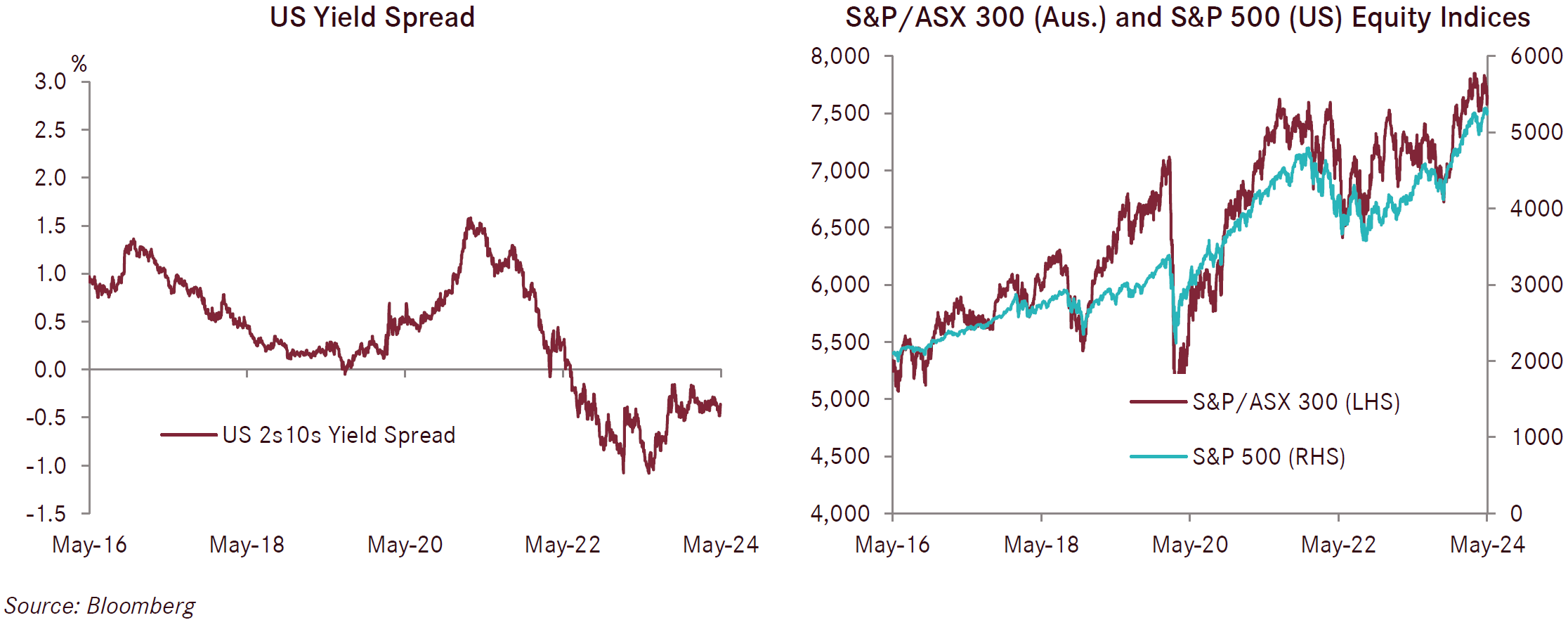

The US S&P 500 led from the front in May, as global equities returned to their winning ways and retraced their April losses. Developed international shares (hedged) rose 4.0% for the month, whilst Australian shares performed more modestly with a 0.9% monthly return. The robust gain of 4.8% in May for US equities was largely driven by a strong quarterly earnings season. Whilst the later half of May saw many global stock exchanges retrace some of the strong performance of the first half, the US stock market remained robust due first quarter earnings growth rate reported to be up 6% higher year-on-year. This was underpinned by strong earnings and demand for AI-related technologies within the technology sector.

Fixed income returns benefitted over the month from falling yields in the US, which saw 10-year US bond yields fall from their yearto- date peak in May. Additionally, softer business conditions gave rise to hopes of earlier than anticipated rate cuts in Australia. However, this was partially offset by disappointing, higher than expected, inflation data in the Eurozone and UK which led to higher yields. The net result was a small gain of 0.8% for international fixed income for the month of May, whilst Australian fixed income saw returns of 0.4%. The price of West Texas Intermediate Crude Oil fell -6% during the month due to softening global demand, while the Australian dollar gained 2.4% against the US dollar, owing to a more dovish Federal Reserve outlook.

The Reserve Bank of Australia kept the official interest rate at the current level of 4.35% at its May meeting. This marks the sixth consecutive rate hold decision by the central bank. There was a general lack of hawkish or dovish tilt in the accompanying statement, with the RBA essentially saying it will not rule anything in or out. However, the RBA acknowledged that inflation is stickier than it would like, with an April CPI recording of 3.6% year-on-year higher than anticipated. Additionally, in response to the widely anticipated rate cuts by Canada and the ECB, the RBA has held firm with its view that Australia is not yet ready to follow suit given its higher inflation levels.

The Australian consumer remains very subdued as measured by the Westpac Melbourne Institute Consumer Sentiment Index which dipped 0.3% to a level of 82.2 points and remains at a level considered very weak. This dip comes as cost of living and inflation concerns weigh heavily on the mind of the domestic consumer, with real household disposable income falling by -0.3% for Q1 2024. The 2023/24 Federal Budget was delivered in May with the aim of easing some of these concerns, with tax cuts as well as electricity relief for many Australians. Additionally, the budget is now expected to be in a surplus of A$9.3 billion (0.3% of GDP), up from the original estimate of a deficit of -A$13.9 billion (-0.5% of GDP). This would be a second consecutive budget surplus, and contrasts relative to the budget deficits seen across many global major economies. Looking forward however, the budget delivered significantly wider projected budget deficits out to 2027/28, ranging between 0.8% to 1.5% of GDP. This is expected to see net debt levels rise from 18.6% to 21.9% of GDP from June 2024 to June 2028. Whilst less problematic than some other major economies (the US currently faces debt to GDP of over 100%), it is a concerning trend.

Economic momentum has ground to a halt in Australia, with a mere 0.1% growth over the first quarter of 2024. This represents an annual GDP growth rate of just 1.1% - the slowest annual growth in more than three decades not including the pandemic. Australian business confidence softened in May with the NAB Business Conditions Index decreasing 1 point to a level of +6 points, and just below long-term average levels. Housing remains a thorn in the side of the RBA and Government, with rental CPI increasing 7.5% year-on-year to April due to a mismatch in the demand and supply of housing, with the backdrop of large rises in immigration numbers. Despite the substantial reduction in borrowing power from households due to higher mortgage rates, the lack of supply has pushed prices of new homes up by 4.9% year-on-year.

After a string of robust demand and inflation readings in the US, market expectations for Federal Reserve rate cuts were delayed through May. This has been validated by the Fed Dot Plot update in June that now forecasts just a single rate cut in 2024 (previously three). However, subsequent CPI data releases for May have been soft, with headline CPI rising 3.3% year-on-year in May versus 3.4% expected. The University of Michigan consumer sentiment index recorded its largest drop in more than three years with a fall of nearly 10 points to a level of 67.4, however this was later revised up to 69.1. Regardless, it remains the lowest in six months and was materially weaker than expectations. The importance of the US consumer cannot be underestimated given consumer spending accounts for approximately 70% of US GDP.

The US ISM Services PMI soared in May to 53.8, the highest in nine months and well above forecasts. The US ISM Manufacturing PMI fell in May with the index down 0.5 points to 48.7. This is a level consistent with a contracting manufacturing sector due to softening demand. Payrolls increased by 272K in May, which was well above expectations of 185K, and follows a disappointing 165K figure in April. This job growth continues to be led by the health care sector. While overall the US continues to show reasonable growth, there are some signs of a slowing consumer that could pose a risk to the economic outlook. Additionally, the looming November US Presidential election is cause for uncertainty regarding the potential flow-on economic effects, namely the introduction of new tariffs and heightened trade tensions.

A key economic development in Europe has been the ECB’s 25 basis point rate cut delivered in the first week of June, though this was widely anticipated by the market through May, priced in at a 99% likelihood beforehand. However, given the absence of any assurance for further cuts from the ECB, plus the accompanied +0.2% revised higher headline inflation forecasts for 2024 and 2025, the market has treated this action as a “hawkish cut”, with Eurozone bond yields slightly rising in response. Another development has been the 2024 European Union elections held in early June, which has seen the rise of far-right nationalist parties at the expense of centrist groups. Additionally, Green Party politicians ceded a significant number of seats, potentially a threat to the continued implementation of the EU’s Green Deal worth 1.8 trillion euros.

The Conference Board’s Leading Economic Indicator for the Euro Area declined by 0.5% in May, to a level of 98.2, while the Conference Board’s Coincident Economic Index increased marginally to 108.7 The HCOB Eurozone Manufacturing PMI rose to 47.3 in May from 45.7 in April, which is the highest reading in over a year, and indicating a potential turnaround in the health of the Eurozone manufacturing sector. While manufacturing remains subdued, the services sector continues to show ongoing signs of strength with the HCOB Eurozone Services PMI falling only marginally to 53.2 in May from 53.3 in April. The services sector, which makes up approximately 75% of GDP and employment across Europe is gaining momentum due to increasing demand and steady employment growth.

UK GDP figures for Q1 2024 arrived in May, and were better-than-expected, expanding 0.6% versus the 0.4% consensus. The rebound in activity has been flagged for some months by the recovery in PMIs. The UK manufacturing sector returned to growth in May, with the S&P Global UK Manufacturing PMI index rising to 51.2, up from 49.1 in April and expanding at the fastest pace in over two years. This growth was underpinned by improved figures for new work, stronger market conditions and efforts to complete existing contracts. The services PMI came in at 52.9 in May, falling from the one-year high of 55 the month prior, but marking the seventh consecutive expansion in the British services sector. The Bank of England (BOE) met in early May and voted to retain the current 5.25% cash rate. However, given the ECB’s 25 basis point cut, the 2.3% inflation year-on-year reading in April (falling from 3.2% in March), and the dovish sentiment from the BOE, markets are eagerly anticipating the first rate cut from the BOE.

China’s shaky domestic demand continues amidst weak inflation data prints, with the May CPI figure rising just 0.3% year-on-year, below the 0.4% market expectation. However, this continues to be an improvement on the levels of deflation experienced in 2023. Consistent with this, Chinese retail sales growth disappointed, rising at 2.3% year-on-year in April, under market forecasts of 3.8% and moderating from 3.1% in the month prior. The Caixin China General Manufacturing PMI increased to 51.7 in May, up from 51.4 in April and surpassing market expectations of 51.5. On the services side of the economy, the Caixin China General Services PMI increased to 54.0 in May, climbing up from 52.5 in April as greater new business inflows and exports spurred faster services activity growth. Against a backdrop of an oversupply of housing and falling property prices, Chinese authorities announced a 300 billion renminbi package for local governments in May to fund the purchase of properties for social housing. Markets are hopeful this is a signal of further fiscal stimulus to come to boost the property sector and spur the Chinese economy.