Investment update - November 2023

Market update

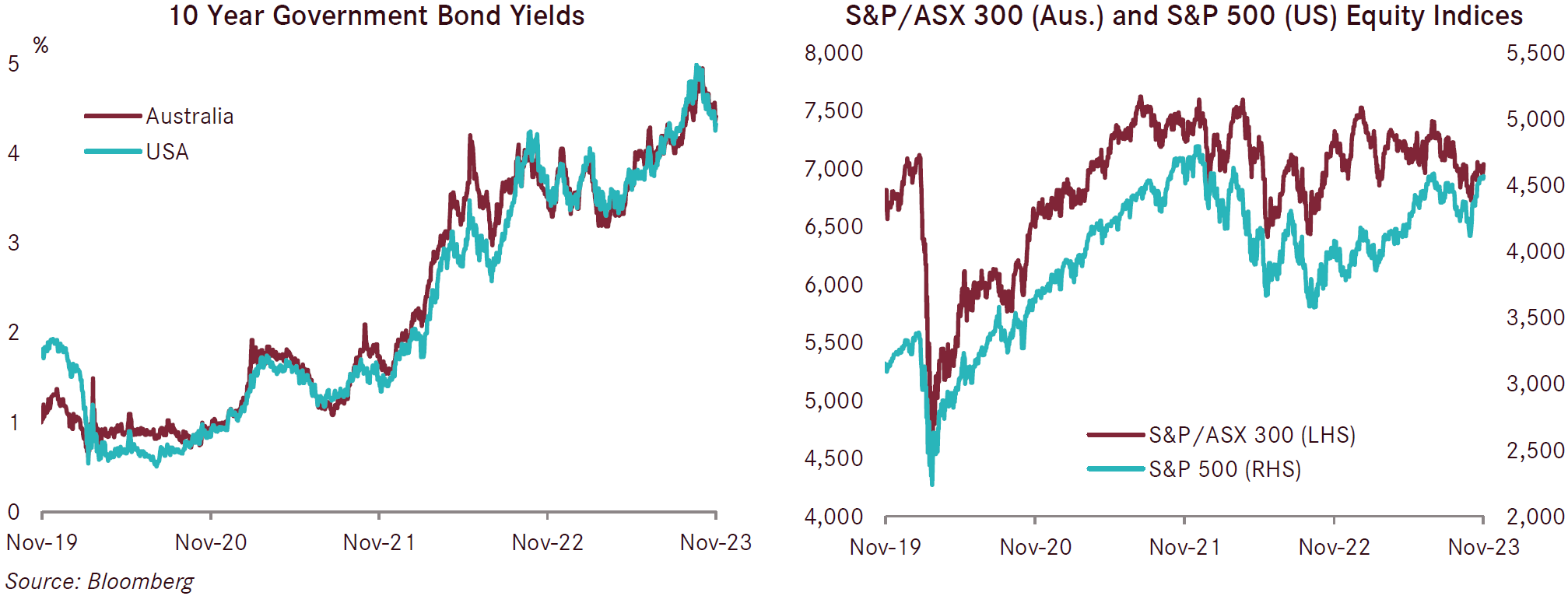

Equity and bond markets reversed their September and October losses with an exceptionally strong November. Inflation prints released over the course of the month showed a marked easing of inflationary pressures in many jurisdictions, including in the United States, the United Kingdom and across the eurozone. While economic growth is showing signs of weakening, investors interpreted the tempering inflation as a sign that central banks, especially the US Federal Reserve (the Fed), have reached the end of this tightening cycle and could begin easing policy by mid-2024, and possibly earlier. Despite policymakers reiterating that monetary policy could be tightened further if necessary, equity markets rallied strongly and bond yields slid, reflecting growing optimism that a ‘soft landing’ scenario could eventuate. Australia remains an outlier to some extent, with inflation not moderating as quickly as it has in other jurisdictions. Elsewhere, geopolitical conflicts remain a point of significant uncertainty and concern, with their effects from a financial market perspective mainly felt in commodity markets to date.

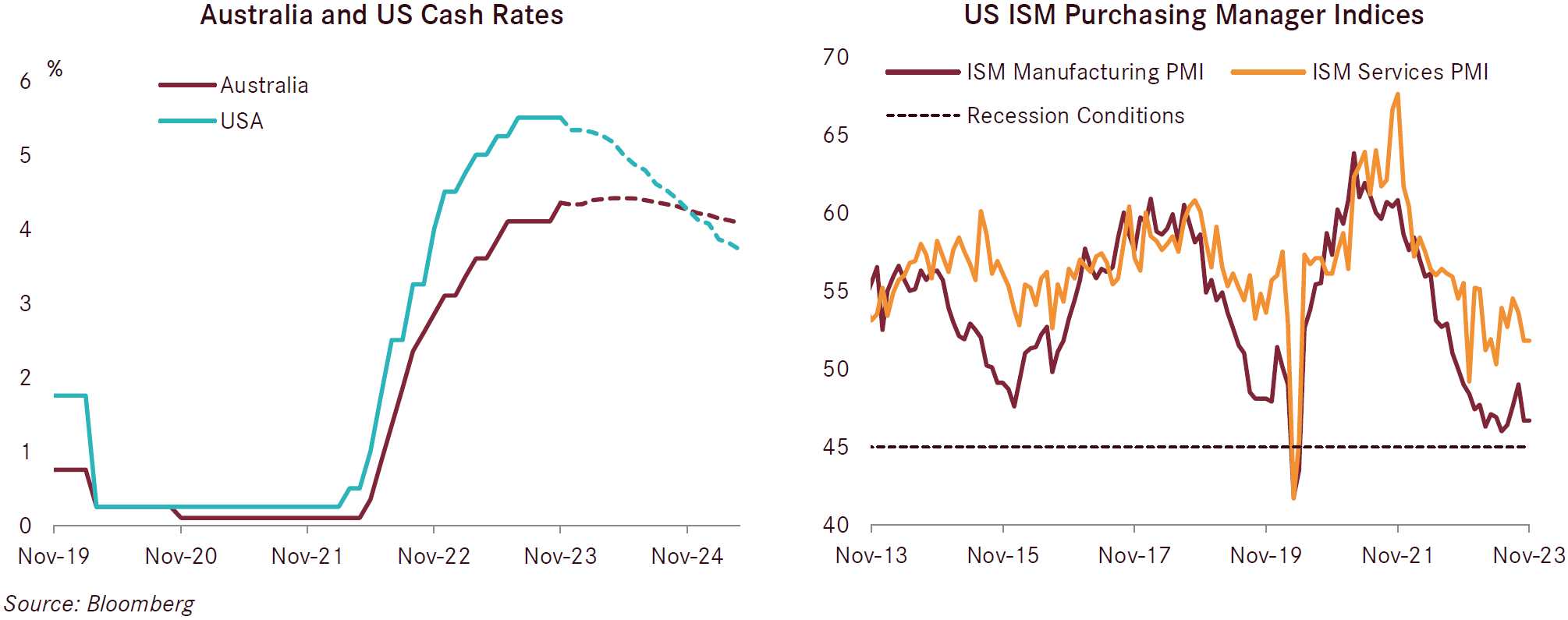

Australia’s Q3 GDP print, released in early December, came in at 0.2% for the quarter, below the consensus market expectation of 0.5%; this brings the annual figure for the year ending in September to 2.1%. Higher than expected government spending, including on the Energy Bill Relief Fund rebates as well as extra payments for childcare, aged care and pharmaceutical products, supported GDP growth. However, the lower-than-expected GDP print suggests the domestic economy may be losing some of its momentum. Furthermore, exceptionally strong population growth – half a million people have joined the Australian economy in the past year through immigration – resulted in GDP per capita falling by 0.5% over the quarter. After raising the cash rate by 0.25% at its November meeting, the RBA opted to leave the cash rate target unchanged at 4.35% at its early December meeting. The softer than expected Q3 GDP result has shifted market expectations on the outlook for further rate rises by the RBA, with markets now pricing in a rate cut as early as the middle of next year.

Australia’s labour market continues to show signs of strength – 54,900 jobs were added over the month of November, 17,000 of which were full-time positions. The unemployment rate remained unchanged at 3.7%; it continues to remain within the 3.4- 3.7% range that has persisted since June 2022. The participation rate bounced by 0.2%, and wage growth has also picked up recently, with the wage price index rising a record 1.3% during the quarter. Other labour market measures are showing signs of a cooling, however, with 0.7% less hours worked in the September quarter compared to the June quarter.

Higher mortgage interest rates led to consumer spending remaining flat in nominal terms over the quarter and to the household savings rate falling to a 16-year low of 1.3% in the September quarter. Continued inflationary pressures on households, higher home loan interest payments due to the RBA’s rate rises, and higher income tax bills this quarter due to the removal of the Low and Middle Income Tax Offset are all contributors to the falling household savings ratio. According to CoreLogic’s national daily Home Value Index, Australian housing prices surpassed their previous peak to reach a new record high. Across the five large capital cities, dwelling prices are up 8.6% on the year to the end of November, with prices rising fastest in Perth (+13.5%), Brisbane (+10.4%) and Sydney (+10.3%). While the strong recovery in property markets may seem counterintuitive given the sharp rise in borrowing costs, the supply and demand imbalance in the market is outstripping any other factors. Listings remain 17% below the previous five-year average nationally and strong immigration continues to drive demand.

Meanwhile, the US economy continues to grow impressively, supported by resilient employment and strong wage growth. The Q3 GDP estimate was revised higher, to a higher-than-expected annualised rate of 5.2%. Consumer spending decelerated somewhat in October, although it remains strong thanks to a resilient US labour market. Inflation fell to 3.2% in the year ending in October, down from 3.7% in September, on the back of lower fuel costs and a tempering in housing costs. Core inflation fell modestly from 4.1% in September to 4.0% in the year ending in October. Despite resilient growth in 2023, some leading economic indicators indicate that the economy is beginning to lose momentum. US manufacturing continues to show signs of weakness, with the US ISM Manufacturing PMI remaining in contractionary territory for the 13th straight month. In addition, the Fed’s December bank assets and liabilities data highlighted a significant deceleration in the annualised rate of commercial and consumer credit growth.

The Fed maintained its benchmark interest rate unchanged at its 22-year high of 5.25% in November. Following the October CPI print, futures markets concluded that the Fed will not raise rates at its mid-December meeting and looking ahead to 2024, investors expect the Fed will begin easing monetary policy in the first half of the year. In contrast, the minutes from the November meeting indicate Fed officials expressed little to no interest in cutting rates anytime soon, with inflation remaining well above the bank’s 2% target.

Economic conditions in the UK and Europe continue to deteriorate, but inflationary pressures have showed material signs of moderation recently. Plummeting energy costs have caused inflation in the eurozone to fall to 2.4% in November, down from 2.9% in October. Stripping out the volatile prices of food and energy, core inflation also came in below expectations, at 3.6% compared to 4.2% in October. The latest inflation readings fell materially in the UK, with headline inflation down by more than 2%, from 6.7% in September to 4.6% in October. The materially lower inflation prints have raised investor expectations that both the Bank of England (BoE) and European Central Bank have reached the end of their respective tightening cycles.

Unlike almost every other developed nation, inflation in Japan appears to be on a sustained rise, for the first time in decades. In October, core inflation rose to 2.9% from 2.8% in September, while headline inflation accelerated from 3.0% to 3.3% over the same period. The Bank of Japan (BOJ) left its policy rate unchanged at its end-October meeting (cash rate at -0.1% and 10-year bond yield target of 0%), however further flexibility to its yield curve control program was announced. The BOJ’s forecast for core inflation is 2.8% in both 2023 and 2024, above the BOJ’s 2% target, prompting investors to speculate when and not if the BOJ will consider some normalisation of monetary policy.

The Chinese economy’s recovery from the COVID-19 pandemic continues to sputter in the face of slower global growth, risks in the local government debt market, an ongoing crisis in the property market and global geopolitical events. Manufacturing activity contracted for the second straight month in November, with the official PMI falling 0.1 points to 49.4 in November (figures below 50 denote a contraction in activity). However, the Chinese government has rapidly expanded government bond issuance in the second half of 2023, which should support the economy in meeting, and potentially exceeding, its 5% target for economic growth in 2023.

Equity markets returned to their winning ways in November, marking their best month amid an already strong year, with investors believing that central banks, particularly the Fed, have reached the end of their monetary policy tightening cycle and will be able to successfully engineer a ‘soft landing’. Australian equities returned 5.1% over the month, while developed overseas equities performed even better, returning 8.0% in hedged Australian dollar terms. The rally in risk markets also saw widespread falls in government bond yields, with the yield on the 10-year US government bond decreasing by 60 basis points from 4.93% to 4.32% over the month and the Australian 10-year government bond yield down by 50 basis points to 4.41% by month-end; the falling yields generated positive returns for fixed interest asset classes. Commodity markets continued to be mixed and volatile, heavily impacted by the conflict in the Middle East. The price of West Texas Intermediate Crude Oil slid for the second straight month, down by 6.2%, after an 11% fall in October, due to the combined effect of worries about the Chinese economy and surging supply as countries such as the US, pump crude at a breakneck pace.