Investment update - November 2024

Market update

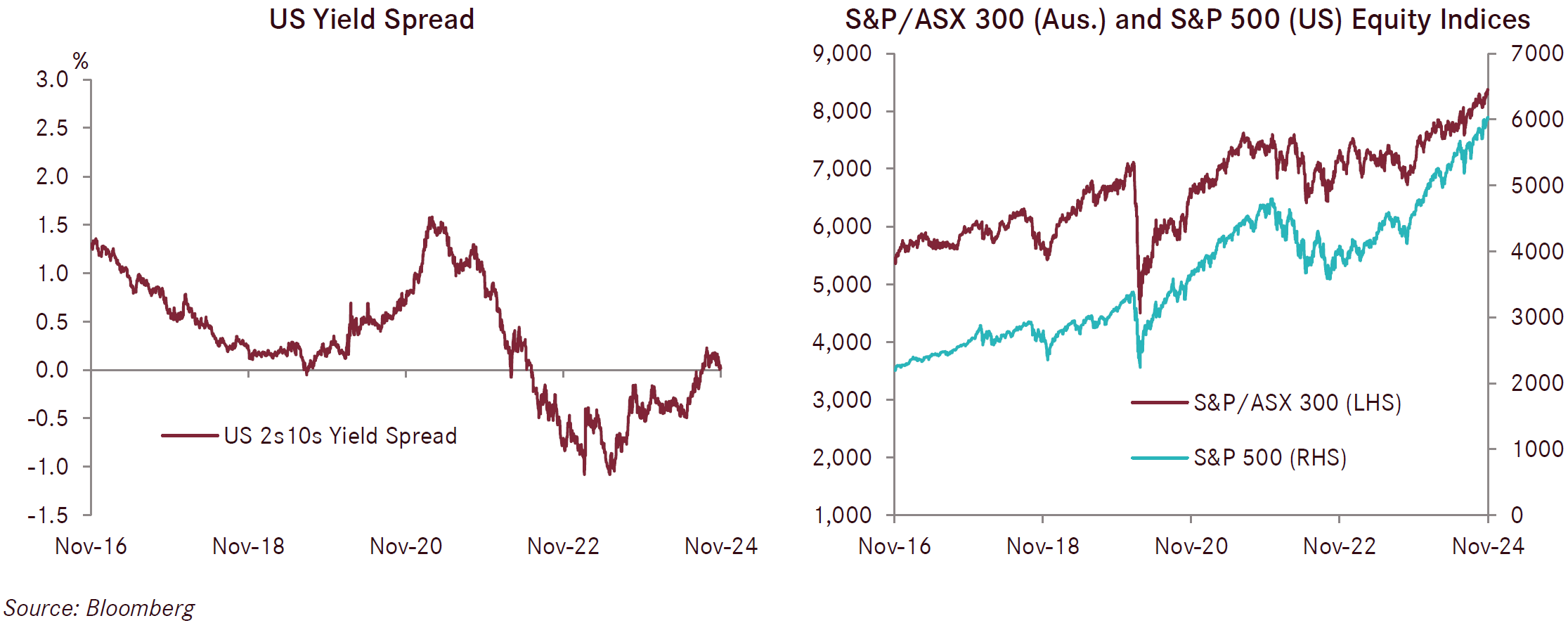

The US S&P 500 had a very strong month in November, increasing by 5.7% and bringing the 12-month return to a remarkable 32%. The strong result was driven by a positive reaction to former President Trump’s successful campaign in the US presidential elections. Not only did Trump decidedly beat Vice President Harris for the presidential race, but the Republicans are set to have control of the presidency, Senate and House of Representatives. Having control through all three key decision-making bodies will make it easier for Trump and the Republican party to implement their policies. Following the election, financial markets focused on the positive elements of Trump’s campaign promises on tax cuts and less regulation rather than the key negative policies for markets in deportation of illegal immigrants and tariffs. President-elect Trump has wasted no time in appointing key positions and announcing new policies, including tariff increases against China, Mexico and Canada. It is highly likely that he will look to enact his policies as soon as possible after he takes office on the 20th of January 2025.

The Federal Reserve cut interest rates by another 25 basis points in early November and flagged further cuts are likely. The next Federal Reserve meeting is scheduled in December, where markets are pricing a good chance of another interest rate cut even though inflation has been stronger than expected in the last few months. European equity markets were mixed with the UK FTSE (+2.2%) and German DAX (+2.9%) standout performers in local currency terms, while the French CAC fell by -1.6%. The Japanese Nikkei fell by 2.2% over the month along with emerging markets, which were -2.8% lower in local currency terms. The Australian share market had a strong month, up by 3.4% recovering from a weaker month in October.

Fixed income performed well over the course of November, delivering gains for both Australian and International Fixed Income, as yields moved lower after a few months of considerable increases. Australian fixed income and International fixed income both delivered gains of 1.1% for the month of November.

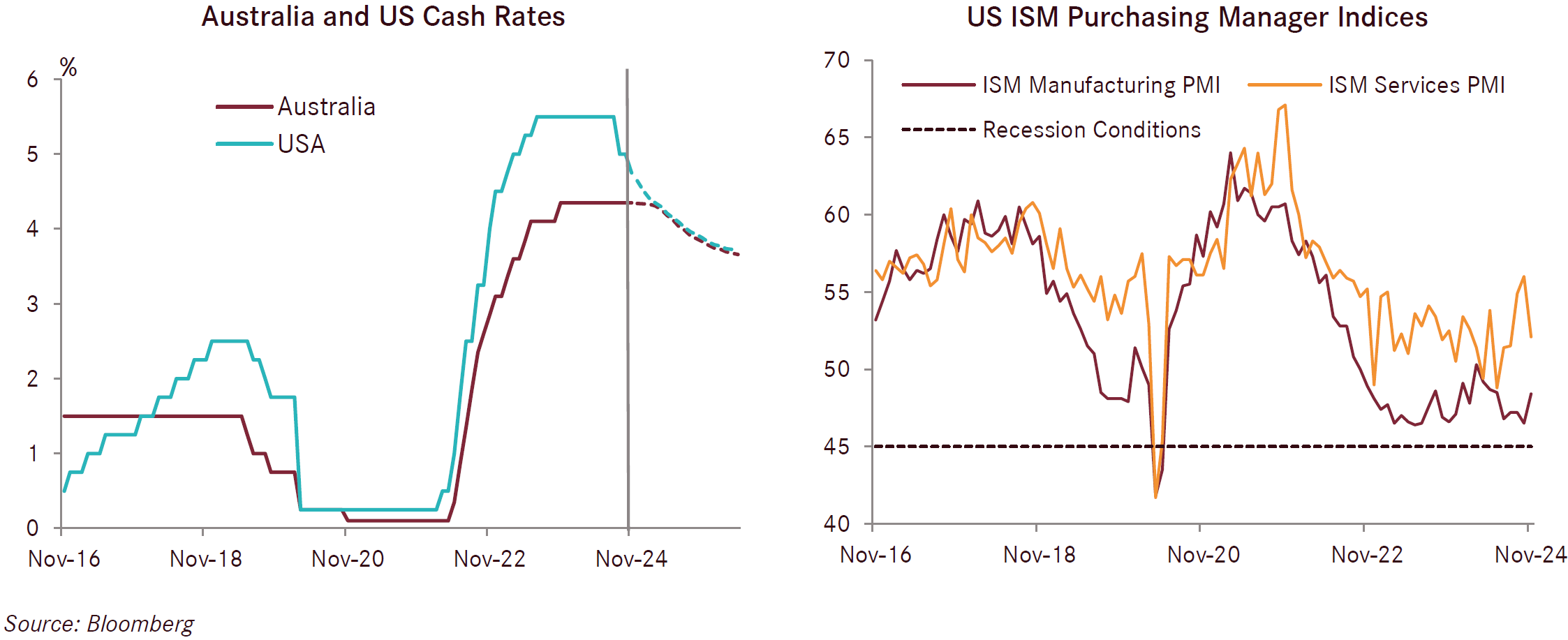

The RBA held the cash rate at 4.35% at its November meeting, which was a widely expected result. The central bank emphasized that sustainably returning inflation to target within a reasonable timeframe remains its highest priority and that underlying inflation remains too high. The Australian Bureau of Statistics monthly inflation measure of headline CPI fell to 2.1% for the 12 months to October and below market expectations of 2.4%. Core inflation fell to 2.4% for the 12 months to end October, down from 2.7% in September. Although inflation is falling, it remains too high for the RBA. Markets expect the RBA to be one of the last major central banks to cut rates, with the first cut anticipated in the first half of 2025.

The Australian economy was revealed in November to have been somewhat sluggish, with GDP growing by just 0.8% for the 12 months ending in September. The growth is very uneven with considerable fiscal expenditure from Federal and State Governments helping cushion the weakness in the property market as high interest rates bite. The residential property market is losing momentum as we head into year end. Price growth is slowing, listing numbers are growing, turnover is on the decline and auction clearance rates are underwhelming. The property market is uneven at the state level with Brisbane, Adelaide and Perth stronger than the major capitals of Sydney and Melbourne. A bounce in the residential property market is only likely to happen once interest rates start falling. Retail sales in October were stronger than expected, up 0.6% for the month and 3.4% for the year. Business confidence increased considerably in October, to a level of 5 points, following hovering around zero for quite a while. Business conditions were unchanged at 7 points and remain around long-term average levels while trading conditions increased to 13 points and profitability was unchanged at 5 points. Overall, the outlook and current trading conditions for businesses are a little brighter than they have been in recent months.

Following the US Federal Reserve’s cut of the cash rate by 0.25% to a range of 4.5 to 4.75% in early November, the Fed has remained with its guidance of markets to expect further rate cuts. Inflation has been stronger than expected for the last few months and should present a challenge for the Federal Reserve to continue guiding market expectations for further rate cuts. In early December, markets were pricing a 66% chance of a rate cut of 0.25% by the Federal Reserve at its 18 December meeting. In particular, core PCE inflation rose by 0.3% in October and 3.1% for the 12 months to end October, above market expectations. The US labour market overall continues to remain resilient with average hourly earnings growing at 4%, overall nominal wage growth at 5.6%, initial jobless claim rates remaining very low and the unemployment rate remaining steady at 4.1%. With inflation ticking up in recent months there is a growing risk that the Federal Reserve is cutting interest rates into a strong economy with little slack to absorb the additional stimulus.

US business indicators were mixed in November with the ISM Manufacturing Index up 1.9 points to 48.4, beating consensus forecasts of 47.5, whilst the ISM Services Index was notably soft, declining from 56 in October to 52.1 in November. The latter result was driven by weakness in all subcomponents including activity, orders, employment and delivery times. Despite these results, the Services PMI remains in expansionary territory, whilst the Manufacturing PMI lingers in contractionary territory.

The ECB lowered its cash rate by 0.25% to 3.25% in October, with another rate cut expected by markets come their December meeting. Whilst inflation has proven to be a little stickier in recent months, economic data supports further rate cuts from the European central bank through the course of 2025. Economic data from Q3 showed a mixed picture, though GDP outcomes were a little better than expected with Germany expanding at 0.2% for the September quarter and avoiding a widely expected technical recession. France was a strong performer, delivering 0.4% expansion driven by construction activity associated with the Olympics, while Spain continued its strong momentum for a third quarter in a row. Italian economic output was softer than expected, with its economy effectively stalling in Q3. While Q3 GDP was solid overall, leading indicators of economic activity remained soft. The Flash HCOB Eurozone Manufacturing Index decreased to 45.2 in October with contractions reported in production, new orders purchasing and inventories. Meanwhile the Flash HCOB Eurozone Services Index also fell by a larger amount than was expected, declining to 49.2 from 51.6, with falls in new orders and inventories a concerning sign.

The Flash S&P Global UK Services PMI Survey fell to 50.0 in November, down from 52.0 in October. The S&P Global UK Manufacturing PMI Survey also fell in November, down to 49.9 from 51.8 in October. Companies in the services sector survey indicated unchanged levels of business activity along with subdued customer demand. Some firms noted delayed investment decisions along with cutbacks to new projects in response to deteriorating domestic business conditions and geopolitical uncertainty. The Bank of England (BoE) dropped the cash rate by 0.25% to 4.75% at its November meeting with further interest rate cuts expected over the next 12 months. The UK GfK Consumer Confidence Index increased by 3 points to -18 in November 2024, which was its first improvement in three months. This improvement was a surprise as it followed Chancellor Rachel Reeves Autumn Budget which revealed significant increases in spending, taxes and borrowing.

While soft at an absolute level, China’s economic data continued to improve over the course of November from a month earlier as the recent stimulus measures began to work through the economy. China's official NBS Manufacturing PMI increased to 50.3 in November from 50.1 in October, which was inline with market expectations, whilst official NBS Non-Manufacturing PMI came in at 50.0 in November and was slightly below expectations. New orders fell while and employment was also softer than that seen a month prior. China experienced deflation of minus 0.3% in November and the 12-month inflation reading to end November stood at just 0.3% and was inline with market expectations. Chinese PPI (producer inflation) fell to minus 2.9% in the 12 months to end October and was a faster decline than markets were expecting. China’s economy will likely face headwinds should incoming President Trump enact his promised tariff increases on Chinese goods. We anticipate more fiscal and monetary stimulus announcements to come from China over coming months.

In Japan, core consumer inflation rose to 2.2% year-on-year in November, remaining above the BoJ’s 2% target and beating consensus forecasts. Such broadening price pressures have strengthened market expectations of a near-term rate hike by the BoJ. The Japanese yen appreciated versus all other major currencies in November in response, continuing its strong performance in the new financial year.