Investment update - October 2024

Market update

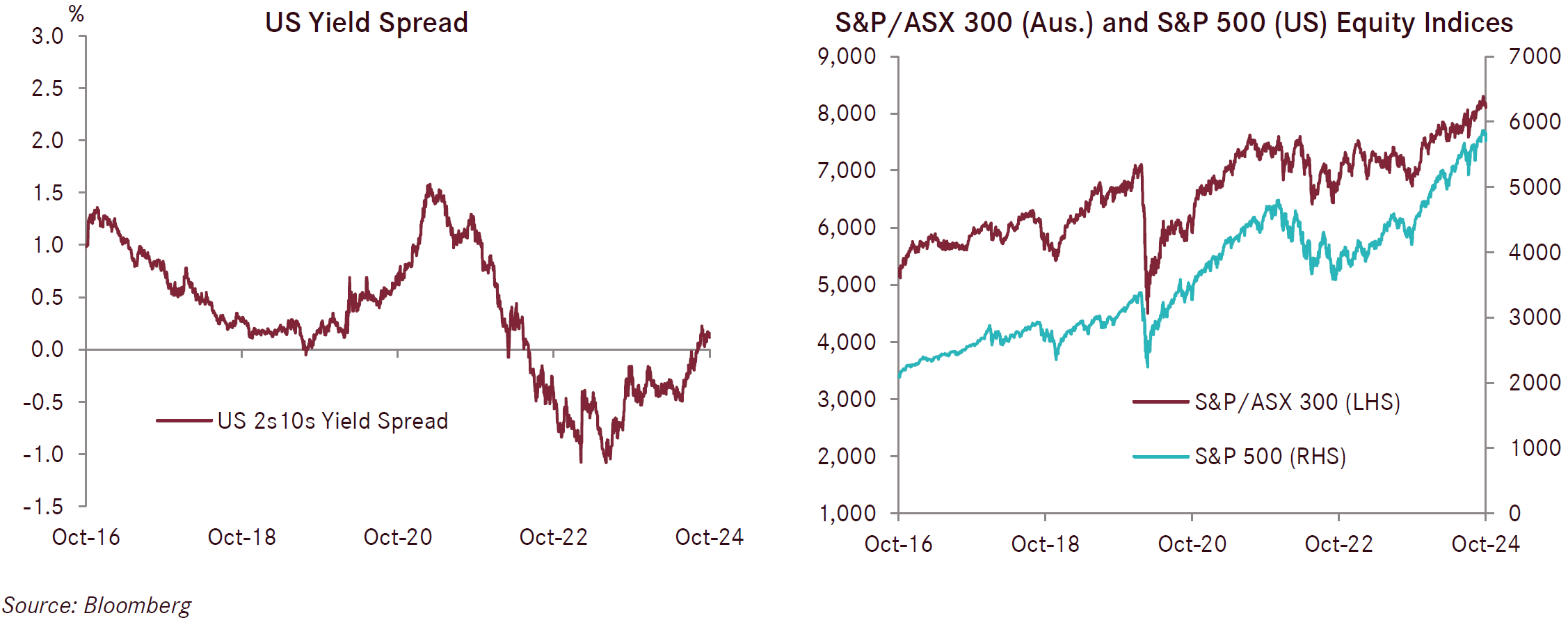

The US S&P 500 decreased in October by 1.0%, a soft result compared with recent times given the US market has been the strongest performer over the last 12 months, delivering a remarkable return of 36%. Higher than expected inflation readings and surprising strength in the US economy have resulted in yields moving higher even though the Federal Reserve has commenced cutting interest rates. The Federal Reserve cut interest rates by another 25 basis points in early November, following the 50 basis point cut in September. European equity markets struggled in October, with the German DAX down 1.3%, the French CAC off 3.7% and FTSE down 1.5%. The Japanese Nikkei was a standout performer, up 3.1% for the month as it recovered sharply from poor performance in previous months. While developed international shares (hedged) were 0.9% lower over the month, on an unhedged basis they were a very strong performer, up 3.9%, driven by the sharp fall in the Australian dollar which was down 5.6% for the month.

The Chinese market reversed some gains over the course of October as initial hopes of large fiscal and monetary stimulus announcements initially flagged in September did not meet market expectations when delivered the following month. This led investors to reduce their enthusiasm for the possible reset in bad debts and commencement of an enduring bull market in China. The Australian share market decreased by 1.3% in October, led lower by the disappointing spending plans from China.

Fixed income was a poor performer over the course of October. Falls were led by the US government bond market as yields across the globe generally moved higher, driven by signs that inflation is proving stickier and the economy stronger than expected. These circumstances would normally not result in central banks cutting interest rates further as this could increase inflation and force central banks to change course on monetary policy. Also causing some concern are the mounting levels of government debt in many economies, and the seeming lack of willingness of politicians to adopt a more prudent and disciplined fiscal plan. Australian fixed income was 1.9% lower over the month of October and International fixed income was 1.5% weaker over the same period.

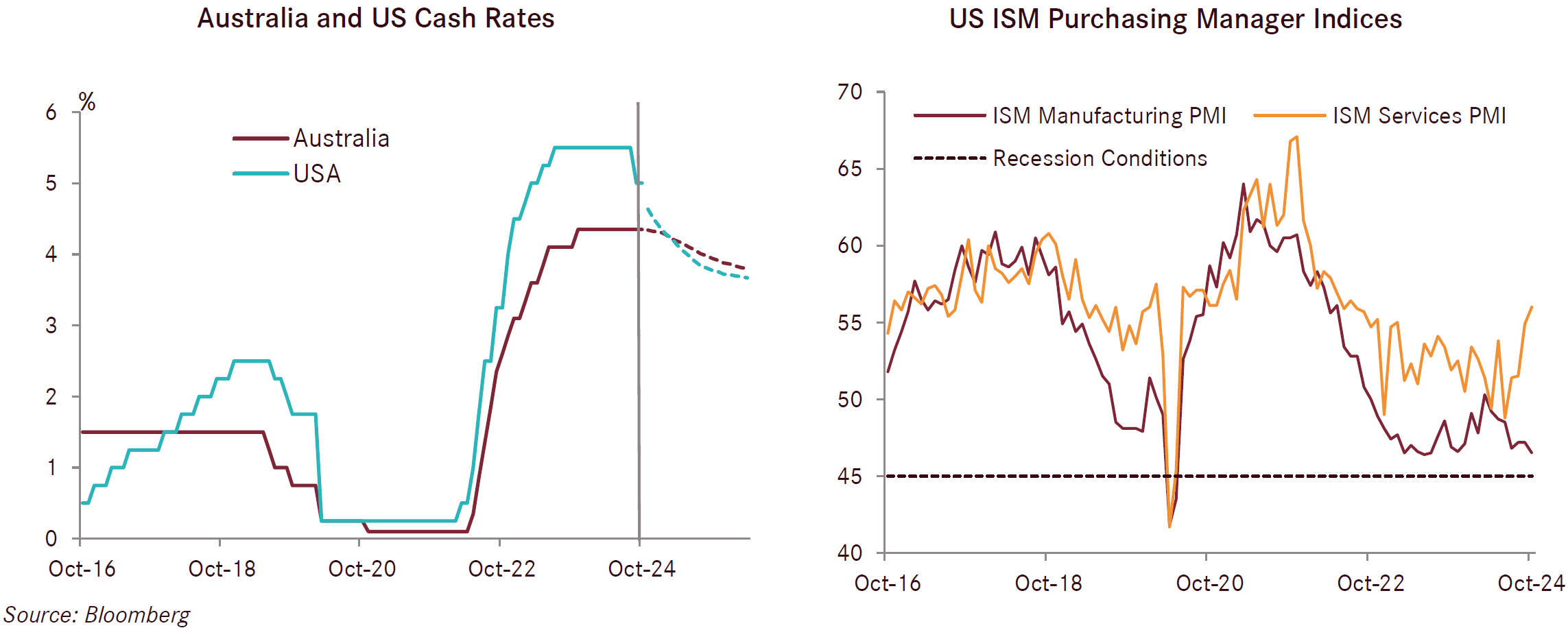

The RBA held the cash rate at 4.35% at its October meeting, a result that was widely expected, with the central bank emphasizing that sustainably returning inflation to target within a reasonable timeframe remains its highest priority. At the end of October, the critical quarterly inflation number from the Australian Bureau of Statistics was released and revealed inflation fell to 2.8% for the 12 months to end September, lower than market expectations of 2.9%. Goods inflation fell sharply, down to just 1.4% over the the 12 months to year end driven by energy bill relief rebates, while services inflation was stubbornly high at 4.6% over the same period. The RBA’s preferred measure of inflation, the trimmed mean, came in at 3.5% for the month and is considerably higher than the 2.5% mid point target the RBA has adopted. The RBA is expected to be one of the last major central banks to cut rates in this cycle, with markets pricing the first cut to occur in the first half of 2025.

Economically, the Australia economy has been holding in reasonably well and there are signs that the pessimism of consumers is starting to fade. The more hopeful outlook is driven by the improving fiscal positioning (tax cuts and energy rebates) as well as receding levels of inflation leading to hopes of interest rate cuts in the near future. While sentiment is improving, outright levels of risk aversion remain highly elevated, and the consumers' willingness to make purchases of major items remain at very low levels. On the business side, NAB’s business survey for Q3 (released in October) showed ongoing pessimism. Business confidence fell 4 points, business conditions fell 3 points, trading conditions fell 4 points, and profitability fell 2 points. Leading indicators also softened further over both 3 and 12 month horizons. Retail sales meekly increased by a softer than expected 0.1% in September and now all eyes will be on upcoming Black Friday sales. Labour market conditions remain tight, helping drive strong wage growth of 4.1% year over year to the end of Q2 2024.

The US Federal Reserve cut the cash rate by a further 0.25% to a range of 4.5 to 4.75% in early November. The Fed Reserve considers that the longer-term neutral cash rate will be around 3% and flagged that more interest cuts are likely. Challenging this view is the stronger than expected US economic and inflation data in recent months. Core inflation increased to 3.3% over the 12 months to end September, ahead of market expectations of holding flat at 3.2%. Core PPI inflation (the inflation that producers of goods are experiencing) was also higher than expected, coming in at 2.8% for the 12 months to end September. In the labour market, data revealed that average hourly earnings, average hours worked and the unemployment rate were all stronger than market expectations. Job openings and job quit rates both fell, suggesting that the forward-looking indicators of the labour market have softened a little. Overall, the US labour market data remains robust and at near full employment. With inflation ticking up in recent months there is a growing risk the that Federal Reserve is cutting interest rates into a strong economy with little slack to absorb the additional stimulus.

US business indicators were mixed in October with the ISM Manufacturing Index down 0.7 points to 46.5 whereas the ISM Services Index was 1.1 points higher at 56, the strongest result since July 2022. Given that the services sector makes up roughly 70% of US GDP, the considerable strength in this sector along with a defiant US consumer paints a picture of a strong and resilient US economy.

The ECB lowered its cash rate by 0.25% to 3.25% in October following a similar move in September as inflation has continued to moderate. Further cuts down towards 2% by the end of 2025 have been telegraphed by the ECB and are broadly endorsed by economists. The ECB meeting minutes revealed that its inflation outlook is for ongoing moderation over the medium term, although it expects inflation to increase over the coming months into Christmas temporarily. Recent downside surprises in indicators of economic activity and ongoing restrictive financing conditions all warrant an ongoing transition to lower interest rates. Headline inflation increased to 2% for the 12 months to end October, ahead of market expectations of 1.9%. Core inflation was unchanged at 2.7% over the 12 months to end October, slightly higher than expectations of 2.6%.

The Conference Board’s Leading Economic Indicator for the Euro Area declined by 0.7% in September, down to 95.2, while the Conference Board’s Coincident Economic Index increased marginally, up 0.1% to 108.6. The HCOB Eurozone Manufacturing Index decreased to 45.0 in September. Germany, Austria, Italy, Ireland and Greece all fell, whereas improvements were recorded in Spain, Netherlands and France. The European Commission Consumer Confidence Index rose by a further 0.5 points in October, reflecting a more optimistic view from consumers on their expected financial situation in light of prospects of further interest rate cuts from the ECB.

The flash PMI UK economic survey data from S&P Global slipped further in October, down to 51.7 from 52.6 the month prior. The S&P Global UK Manufacturing PMI Survey also fell in October, down to 49.9 and sharply below expectations of 51.4. The S&P Global UK Services PMI fell to 52, with a slower rate of growth driven in part by uncertainty around the Autumn Budget, which was released on the last day of the month. The Autumn Budget revealed landmark changes, with taxes facing their largest raise since 1993. In particular, the 1.2% increase to employers’ national insurance requirements, as well as the lowering of its income threshold, has businesses pinching at their wallets. The Bank of England (BoE) dropped the cash rate by 0.25% to 4.75% at its November meeting with further interest rate cuts expected over the next 18 months.

China’s economic data improved over the course of October. Retail sales rose by 3.2% over the 12 months to end September, well ahead of market expectations of a 2.5% increase. The Caixin China Manufacturing PMI increased to 50.3 in October from 49.3 in September and was ahead of market expectations, while the Caixin China General Services PMI increased to 52.0 in October from

50.4 in September. In recent months, Chinese authorities have announced a series of large monetary and fiscal policy stimulus measures aimed at boosting confidence and consumption of consumers, along with recapitalising local governments that are heavily in debt. While many of these stimulus measures have resulted in a short-term uplift in share prices, none of them have been sustained. This leads to an ongoing question as to when Chinese authorities will release sufficient stimulus to turn the economy around and put a bottom in markets, which markets speculate will be heavily informed by the recent results of the US Presidential Election. If the Republicans achieve the so-called “red sweep” controlling Congress, Senate and Presidency, this will pave the way for the incoming president to implement a broad range of policy initiatives, a key uncertainty for the economic outlook, including its geopolitical and trade considerations.