Investment update - September 2024

Market update

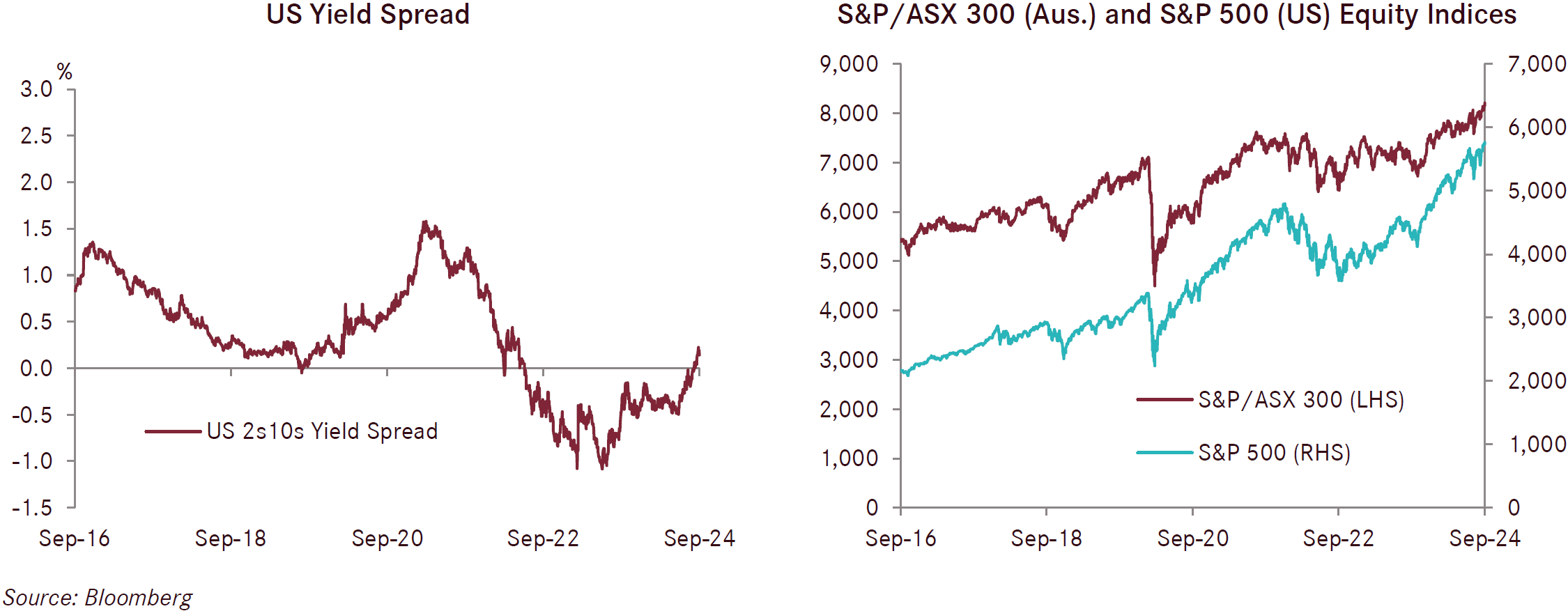

The US S&P 500 increased in September by 2.0%, despite being 4% lower early in the month. The US market benefited from the decision by the US Federal Reserve in September to cut the cash rate by a larger than anticipated 0.5% to a range of 4.75 to 5%, the first cut in four years. The larger than expected cut was interpreted to be mainly due to concerns over the slowing labour market, however the US Fed was positive on the state of the economy and the direction of inflation noting the committee “has gained greater confidence that inflation is moving sustainably toward 2 per cent, and judges that the risks to achieving its employment and inflation goals are roughly in balance”. In Europe, the German market was the best performer, increasing by 2.2%, while the French index was up 0.1%, and the UK fell by 1.7%. Developed international shares (hedged) were 1.4% higher over the month. Unhedged developed international shares fell by 0.5% in September as the Australian dollar increased in value, decreasing the value of international shares for Australian investors. The Chinese market was the best performer in the month globally, increasing by over 17%, and contributing to the 4.3% return from unhedged emerging market shares. The strong rally in Chinese shares occurred in response to the announcement of significant monetary and fiscal stimulus by Chinese authorities. This also supported the Australian share market which increased by 3.1% in September; the resources sector was up by over 9% in the month including BHP and Rio Tinto increasing by 13% and 16% respectively, as investors rotated out of financials into resources.

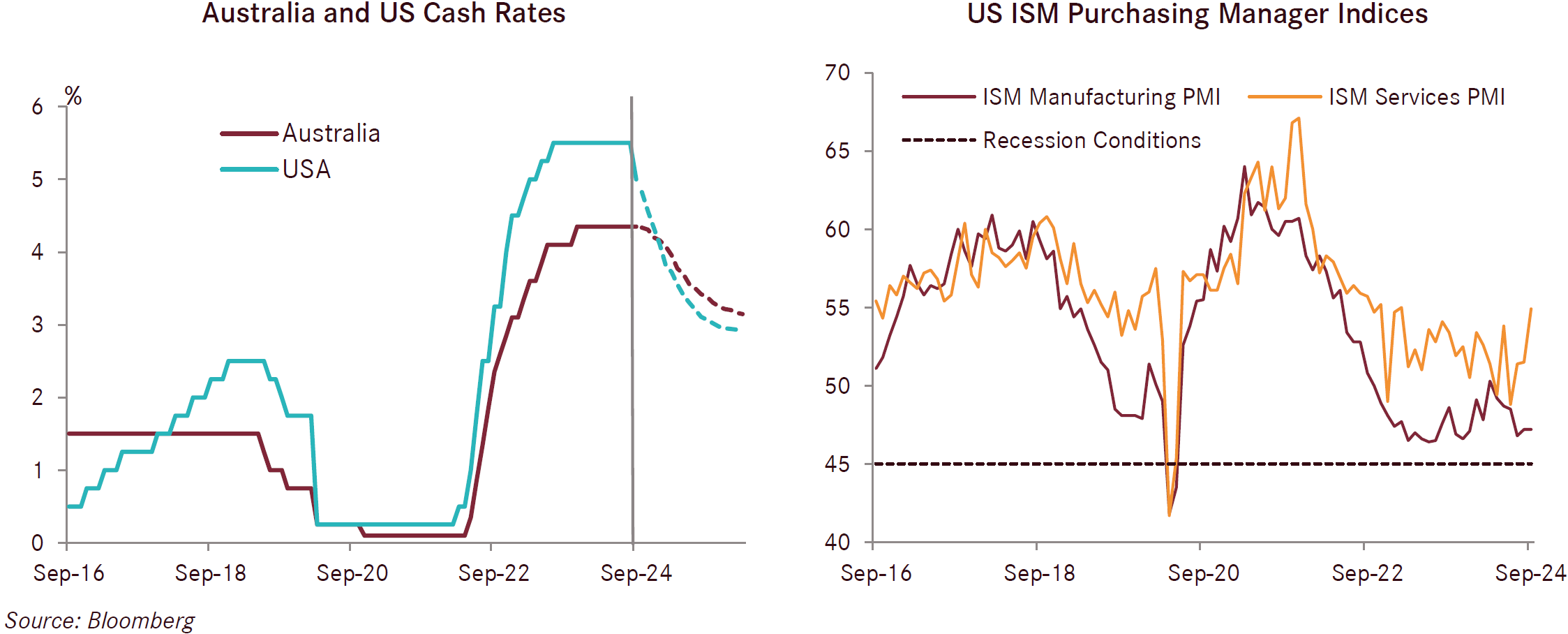

Fixed income asset classes provided positive returns in September with international fixed income up 1.1% and Australian fixed income returning 0.3% for the month. A number of major global central banks have now commenced on a rate cutting cycle and global bond markets have continued to price in expectations for considerable interest rate cuts over the next two years. For example, the US bond market is pricing in a further nine interest rate cuts through to the end of 2025. By comparison, at its September meeting, the Reserve Bank of Australia (RBA) reiterated that it is unlikely there will be any rates cuts in Australia before 2025, resulting in a more subdued return for Australian fixed income in September.

The RBA held the cash rate at 4.35% at its meeting in September and emphasised that sustainably returning inflation to target within a reasonable timeframe remains its highest priority. While headline inflation as measured by the monthly CPI indicator declined to 2.7% in August, the RBA notes part of this fall is temporary and due to federal and state cost of living relief measures. Core inflation (trimmed mean) has proven far stickier and it was 3.9% in the year to end June and is not forecast by the RBA to return to target until 2026. As such, the RBA is expected to be one of the last major central banks to cut rates in this cycle, with markets pricing the first cut in February 2025.

Australia’s growth has slowed on lower immigration, very low productivity growth and as a cautious consumer navigates the high interest rate environment. NAB’s business confidence index improved from -5 in August to -2 in September, however input cost growth remained elevated. Consumer confidence improved from 84.6 in September to 89.8 in October as consumers are no longer fearful that the RBA will raise rates further given inflation continues to moderate. Demand remains supported by employment conditions and large fiscal expenditure programs from state and federal governments. Retail sales increased by a stronger than expected 0.7% in August, marking the fifth month in a row of increases. Labour market conditions remain tight. The unemployment rate remained at 4.2% in August, with 47,500 new jobs created in the month, well above expectations for 25,000.

The US Federal Reserve’s decision to cut the cash rate by 0.5% to a range of 4.75 to 5% was only priced at a 60% probability leading into the meeting. The updated median dot shows a further 0.5% in cuts by the end of 2024, followed by 1.0% of cuts in 2025 to 3.375%, and a further 0.5% of cuts in 2026, which is close to market pricing. In its statement, the Fed noted indications that economic activity continues to expand at a solid pace, job gains have slowed, and the unemployment rate has moved up but remains low. It also stated that it had made further progress towards the 2% inflation objective, but that it remains somewhat elevated, and that the cut balanced its two goals of bringing down inflation and supporting maximum employment. US Fed Chairman Powell described the cut as insurance against a possible economic slowdown and higher unemployment. The US Fed forecasts unemployment to be 4.4% by the end of 2024 and GDP growth at 2.0%.

The recent flow of US data has continued to show slowing inflation. Headline inflation fell to 2.5% in the year to August 2024, with core inflation at 3.2% and US core PCE at 2.7%. The US ISM Services PMI was much stronger than expected in September at 54.9 compared to 51.5 the previous month and 51.7 expected. New orders jumped from 52.5 to 59.4. However, the employment subindex moderated from 50.2 to 48.1. The US ISM Manufacturing PMI was steady at 47.2 in September.

The US September employment data was meaningfully stronger than expected, with non-farm payrolls (new jobs) up by 254,000 compared to forecasts of 140,000 and the unemployment rate fell by 0.1% to 4.1%. In addition, the August payroll numbers were revised up to 159,000. This was in contrast to previous months which indicated a weakening jobs market. Overall, the US economy remains solid ahead of the US election on 5 November, which is a key event for the economy and markets given the polls remain tight and the likely impact if some of the policies announced to date were to be implemented.

The ECB lowered its cash rate by 0.25% to 3.5% in September following a similar move in June as inflation has continued to moderate. A further cut at the October meeting is close to fully priced as several ECB Governing Council members have publicly noted signs of headwinds to growth and softening labour demand as well as progress with a sustainable fall in inflation back to the 2% target. Headline inflation fell to 1.8% for the 12 months to end September, below the 2% target. Core inflation also moderated to 2.7% over the 12 months to end September from 2.8% to end August.

The Conference Board’s Leading Economic Indicator for the Euro Area declined by 0.8% in August, down to 95.8, while the Conference Board’s Coincident Economic Index increased marginally, up 0.1% to 108.7. The HCOB Eurozone Manufacturing Index fell by 0.8 to 45.0 in September. Germany, Austria and France led the contraction, whereas momentum was positive in Spain. New orders continued to fall and job retrenchments increased. The services sector PMI fell to 51.4 in September from 52.9 in August. The European Commission Consumer Confidence index rose by 0.5 points in September reflecting a more optimistic view by consumers on their expected financial situation with the prospects of further interest rate cuts from the ECB.

The flash PMI UK economic survey data from S&P Global consolidated in September at 52.6 compared to 53.8 the previous month, but well above the 50 no change level. The S&P Global UK Manufacturing PMI Survey fell from 52.5 in August to 51.5 in September as export demand, particularly from Europe, continued to fall offsetting strong domestic demand. The S&P Global UK Services PMI fell from 53.7 to 52.4 with employment gains losing momentum amid increased wages. The Bank of England (BoE) kept the cash rate unchanged at 5.0% at its September meeting, following a 0.25% cut at its August meeting. BoE Governor Bailey has since stated the central bank could become a “bit more aggressive” in cutting rates if news on inflation continued to be good, contrasting his previous comments about moving gradually, with markets nearly fully pricing in two more cuts in 2024.

China’s economic data has remained soft due primarily to the housing sector. Retail sales rose by 2.1% over the 12 months to end August, moderating from 2.7% the previous month. The National Bureau of Statistics Consumer Confidence Survey fell to 85.8 in August from 86 in July and just above an all time low of 85.5 during the pandemic. The Caixin China General Services PMI declined to 50.3 in September from 51.6 in August and was below market expectations, while the Caixin China General Manufacturing PMI fell to 49.3 in September from 50.4 in August, signaling contraction amid a renewed downturn in new orders, including exports. However, in late September, Chinese authorities announced a series of very large monetary and fiscal policy stimulus measures including a 0.5% cut to mortgage rates and financing for local governments to buy unsold private housing aimed at putting a floor under house prices and generating demand and inflation, as well as to achieve the country’s 5% growth target this year. The initial market reaction was very positive, with Chinese shares up by 25% in a week, albeit short covering contributed to this increase.

There were strong moves in commodities markets in September with China’s stimulus announcements helping the copper price to increase by 6.4%. Gold continued to strengthen, up 4.6% in September, in part due to an escalation of conflict in the Middle East. However, the oil price fell by 7.3% in the month on rising supplies from OPEC and weak demand in China.